A CONFUSED SEA STATE

Mariners, merchant marines and experienced amateur sailors alike, loath the dreaded “confused sea state”. Which refers to a chaotic ocean surface where waves come from multiple directions, often with varying heights and periods. This results in a highly irregular and unpredictable wave pattern that can make navigation and boat handling difficult. It’s often a result of a sudden wind shift or overlapping swells from different sources. This is the perfect metaphor for the equity markets in the first half of this year. For market participants it was a major challenge to just keep up with the news cycle. The shifting winds of the macro narrative and overlapping stories pingponged from budget deficits to tariffs to wars in the Middle East to the war in Ukraine to interest rates; all changing on a near hourly basis!

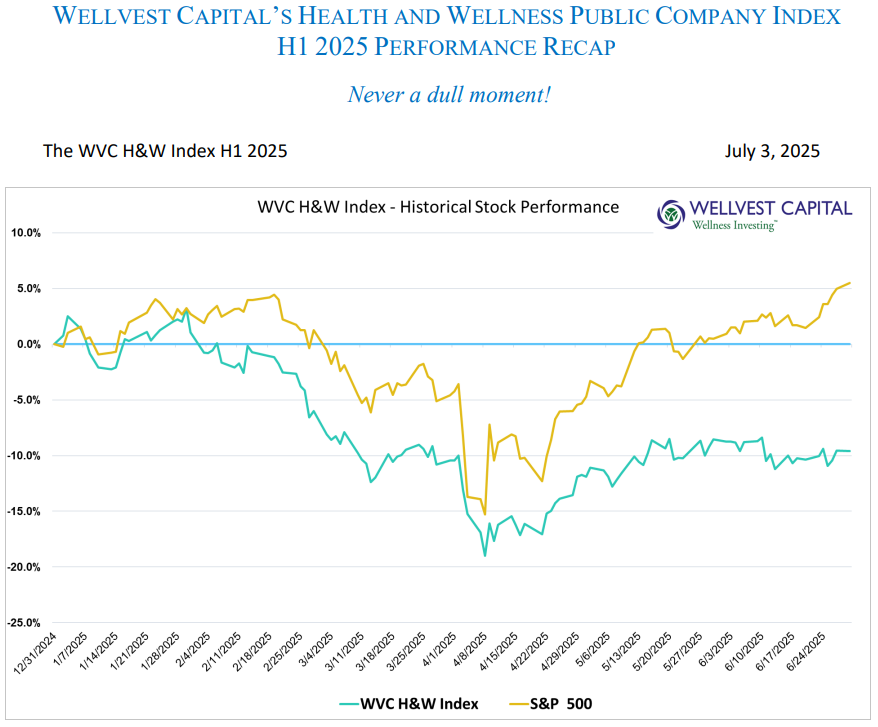

When the 2nd quarter ended on June 30, 2025, the S&P500 was up 5.50% YTD, excluding dividends. This snapshot garden variety performance masked the extreme market volatility over the course of the last six months. The low for the S&P500 was 4,982 achieved on April 8th, which was down 15.28% from the start of the year and nearly 20% from the YTD high. This was driven by President Trumps “Liberation Day” tariff announcement that shocked the financial markets and nearly toppled the bond market. The pausing of these tariffs and softening of the rhetoric created a boomerang effect. Old time market sages call it a “V Bottom”, due to the chart pattern the price action creates. The rest of April witnessed continued high volatility, but the market found its footing in early May and into June with steady decreases in volatility and a steady grind upward.

THE HEALTH AND WELLNESS TRADE FADES

The halo effect of the MAHA platform that was sparked after the election bled into early 2025 only to quickly fade as the markets started to rollover in early February. At January’s month end the WVC H&W Index was on par with the S&P500. During the height of the tariff turmoil the WVC H&W Index was down 19.01% for the year at its low point. Following the broader market the WVC H&W Index staged a respectable recovery, ending the first half of the year down 9.59%, excluding dividends. Respectable recovery, yes, but still lagged the S&P by a considerable margin. Notable was the muted response of the WVC H&W Index during the sharp rally in the S&P500 in mid-April. While we cannot say for sure, it appears investors panic sold many of the names in the WVC H&W Index and then rotated into mega-caps to get quick high beta upside exposure.

While all this was going on, Team MAHA was busy putting into action many of its talking points and high priority agenda items. MAHA’s mandate of reducing harmful food additives, potentially aligning U.S. standards closer to Europe’s more stringent regulations, and promoting fresh, minimally processed foods is starting to be implemented. One of the first steps is transitioning out of artificial food colorings which was announced by HHS on April 22, 2025. These regulatory changes and the health narrative they promote are a tail-wind for the health and wellness sector and bullish for the WVC H&W Index.

However, this bullish underpinning was no match for the cross currents that overwhelmed the market in the first half of the year. The WVC H&W Index was down 9.59% for the period ending June 30, 2025, with a heavy bias to the losers. The index had 17 winners generating an average 17.75% gain for the period. This strong performance was shadowed by the 31 losers that sank an average of 24.59% over the first six months of 2025. On the positive side the big winners include Celsius Holdings (CELH), up 76.1% YTD on strong earnings and the Alani Nu acquisition. Sprouts Farmers Market (SFM) gained 29.5% driven by solid same store sales growth and earnings beats. Rounding out the top five winners was Basic-Fit (BFIT) increasing 29.0%, Herbalife Nutrition (HLF) clocked in a 28.8% return for the first half of the year, and Chewy (CHWY) was up 27.3%.

WEAKER PLAYERS CONTINUE TO STRUGGLE

The market conditions over the first six months have put investor on edge. Their tolerance for missed earnings, poor capital allocation, and patience with management teams that are slow to course correct has dwindled too next to nothing. It’s a shoot first ask questions later mentality. Unfortunately for a broad group of companies in the WVC H&W Index, investors have left them for dead. Weight Watchers (PINK: WGHTQ) is the poster child, having failed to capitalize on the GLP-1 trend, the company filed Chapter 11 on May 6, 2025. The stock is down 75.8% as of June 30th. The Hain Celestial Group’s (HAIN) long time lack of strategic focus has come home to roost. The stock has lost 75.1% of its value this year, the CEO has been fired, and the balance sheet is bloated with debt. A similar story was found at Helen of Troy (HELE), down 52.6% YTD, with its heavy reliance on sourcing from Asia, tariffs are having a large impact, the CEO resigned abruptly, and earnings have collapsed.

Coil the Spring – be prepared

Many of the other weak performers in the WVC H&W Index have been negatively impacted by a host of factors including tariffs, stale product offerings, lack of innovation, and weak business models. As we have said many times, the health and wellness trend is a lasting multi-generational shift in consumers behavior, impacting their purchasing decisions across a wide range of goods and services. This trend is fertile ground for companies that share the same attributes as all great companies; excellent leadership teams, strong gross margins, nimble operations, and an authentic dedication to providing customers with the best possible solutions. For investors in the health and wellness sector, fundamental, bottoms-up research is the best way to sift out the winners.

About WELLVEST CAPITAL’S HEALTH AND WELLNESS PUBLIC COMPANY INDEX

In 2021 with the intention of capturing the new health and wellness investment dynamic, Wellvest Capital created our proprietary “Health and Wellness Index” (WVC H&W Index). This index is comprised of approximately 50 US publicly listed companies of all capitalizations that are active participants in the health and wellness industry providing a wide range of goods and services. Being a rapidly evolving sector with many emerging small-capitalized businesses competing with legacy large cap companies, the index utilizes an equal weighted calculation methodology. Better-for-you food and beverages, vitamins & supplements, fitness apparel and equipment, ingredient suppliers and weight loss are characteristic of the categories included. Beyond Meat, Lululemon, Oatly, SunOpta, Nestle, The Honest Company, Sprouts Farmers Market, and Peloton are representative of the group.

We would love to hear from you.

David Thibodeau

david@wellvestcapital.com

Rob Rafferty

rob@wellvestcapital.com

Please visit Wellvest’s library of insights and articles at wellvestcapital.com/newsroom

Data sources: Pitchbook, Standard and Poor’s

Copyright: Wellvest Capital 2025