HIGHLIGHTS

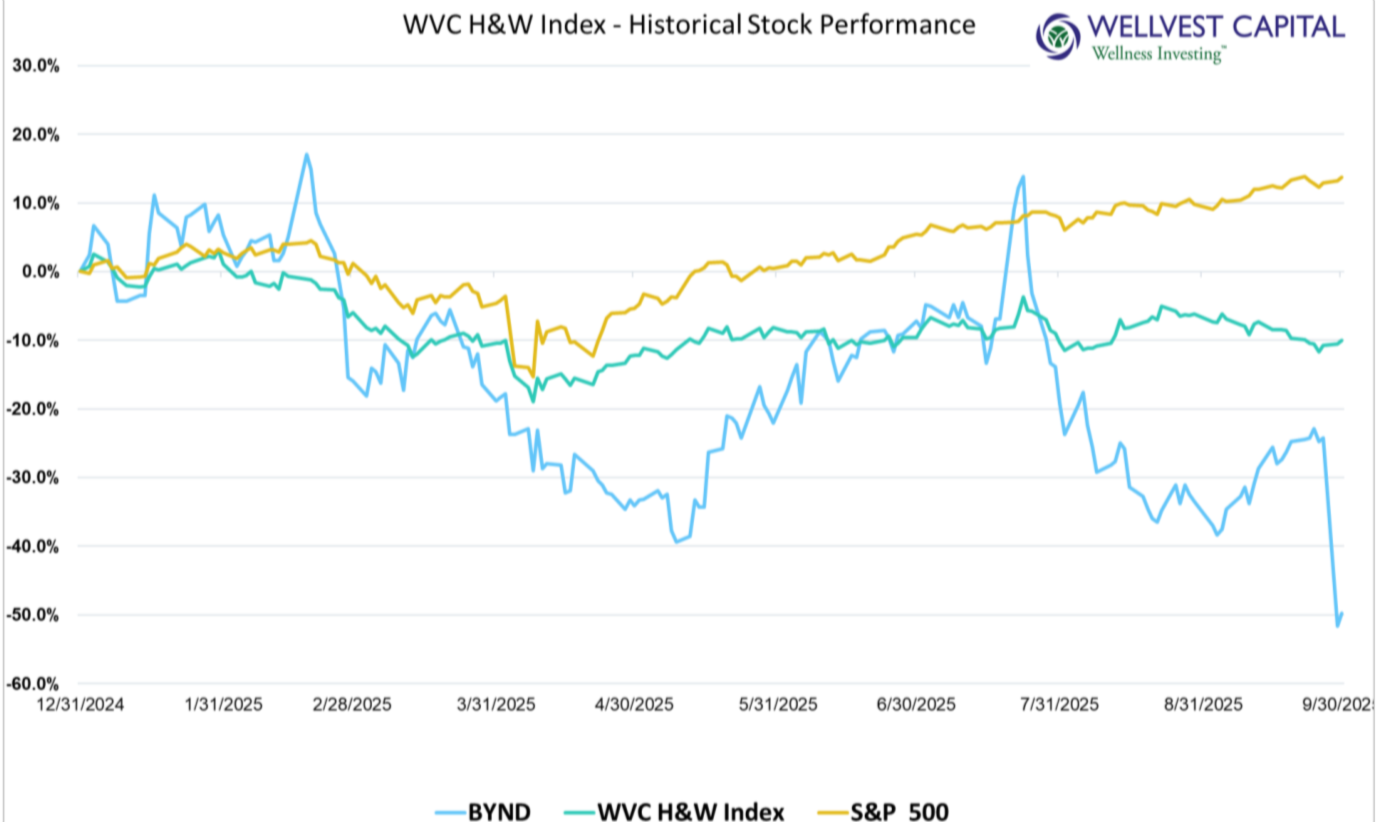

The Wellvest H&W Index lost ground to the bell weather S&P500 for the month, gapping to a negative 23.77% for the year, up from negative 15.99 at the end of August. The H&W Index settled down 10.05% YTD, compared to the S&P 500 gain of 13.75 YTD, excluding dividends. This divergence is a bit unsettling for the H&W bulls since the broader small caps did well, with the Russell 2000 index returning 4.74% for the month. Unfortunately, this market tail wind did not have a strong impact on the H&W Index. As we have conjectured in past reports, the weak business models are being exposed as investors abandoning these names in search of better returns elsewhere. The innovation rose has come off the bloom in the health and wellness sector.

September is historically a weak month for equities. But like just about everything this year historical patterns and norms are not playing out as designed. In anticipation of the Fed cutting interest rates, the S&P500 had a strong month going into the meeting. Typically, these types of events are “buy on the rumor, sell on the news”; the surprise this time around was the market had the briefest of selloffs, ~10pbs, upon the Fed announcements on the 17th. The next day it hit a new high. Go figure!

THE FALLEN POSTER-CHILD

In May 2019 Beyond Meat (BYND) went public to great fanfare and success. By January 2021 it had a market cap of over $12Billion. At the time the company was viewed as an amazing innovator and the future of protein. 2021 was also the peak year of the company’s revenue, at $464Million, however it never reported a profit. That same year is lost $182Million and the red ink has been flowing ever since. The company has shored up its balance sheet with more and more debt and other financial tactics to keep itself afloat. In the meantime, the equity investors have been nearly wiped out. Today the market cap is about $145Million. The stock recently traded at $1.92, down from a peak price of $239.71 in 2019.

Innovation and trend setting in health and wellness is what creates lasting benefits for all stakeholders. Investors are well guided when they support these companies. But at the end of the day, innovation needs to be paired with sound business models and capital structures that reward investors for the risk taken. The equity markets can be blinded by the same hype, fads, and trends that drive consumer products, but this will only last so long. Eventually consumers stick with goods and services that are a good value and meet their needs. Likewise, eventually investors support companies that deliver bottom line profitability and long-term returns.

- Top Five Winners

|

|

|

|

|

|

|

|

|

|

- Top Five Losers

|

|

|

|

|

|

|

|

|

|

Data sources: Pitchbook

Copyright: Wellvest Capital 2025