HIGHLIGHTS

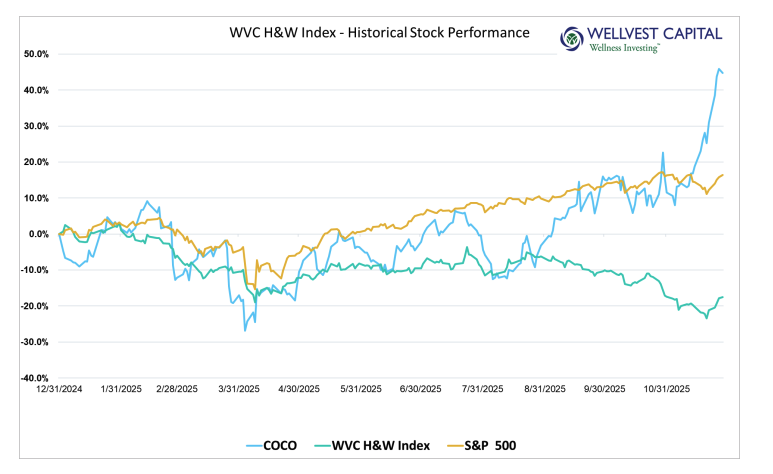

The Wellvest H&W Index held its’ own against a volatile S&P500 for the month of November. Both the H&W index and the S&P500 had very slight gains of 0.14% and 0.10% (excluding dividends) for the month respectively. The H&W Index continues to have a wide performance gap of negative 33.91% versus the large cap index year to date. Hiding behind the placid monthly numbers were a surprising amount of volatility. On any given day in November the sky was falling or the market latched on to the savior of the moment to push higher. A challenging environment to say the least!

The battle between the bulls and bears is in full relief. The Wellvest H&W Index is no exception as several of its constituents experienced extreme monthly moves as high as 80% to the upside and 45% to the downside. Fear and greed is running rampant across the equity spectrum, how this will playout is anyone’s guess. After a strong showing over the last few years, caution may

be the best course of action at this juncture.

A BIT OF PARADISE

The Vita Coco Company (COCO) is an interesting case study for the health and wellness sector. The company is an innovator in functional beverages, turning little known coconut water into a mainstream product. Founded in 2003, an IPO in 2021, and now a $3 Billion market cap with revenue over $600 Million and strong profitability; the company is the definition of success in health and wellness. November was a great month for COCO with the stock up 29.7% bringing the YTD gain to 44.7%. This jump was driven by a positive earnings beat and a bullish article in Barron’s.

COCO was not the only high performer in the H&W Index in November. Beachbody (BODI) had an 82.1% spike upon reporting its first quarterly profit since going public, which supported sell-side analysts upgrading the stock. The same thing happened at Herbalife Nutrition (HLF), great earnings and analyst upgrades. This marked an outstanding month for HLF up 59.1% and 90.3% YTD. Offsetting

these gainers were some sizable losers. Beyond Meat (BYND) round-tripped its meme infused pop, down 40.5% for the month and negative 73.9% for the year. Laird Superfood (LSF) continued to slide, off 44.65% in November and 65.2% YTD. Primo Brands (PRMB) lopped off significant value, with a 28.6% drawdown over the last thirty days, and 49.0% since January 1, 2025. As painful as these losses are, it’s welcoming to see the market and the media discovering some of the outstanding companies in the health and wellness sector.

- Top Five Winners

|

|

|

|

|

|

|

|

|

|

- Top Five Losers

|

|

|

|

|

|

|

|

|

|

Data sources: Pitchbook

Copyright: Wellvest Capital 2025