HIGHLIGHTS

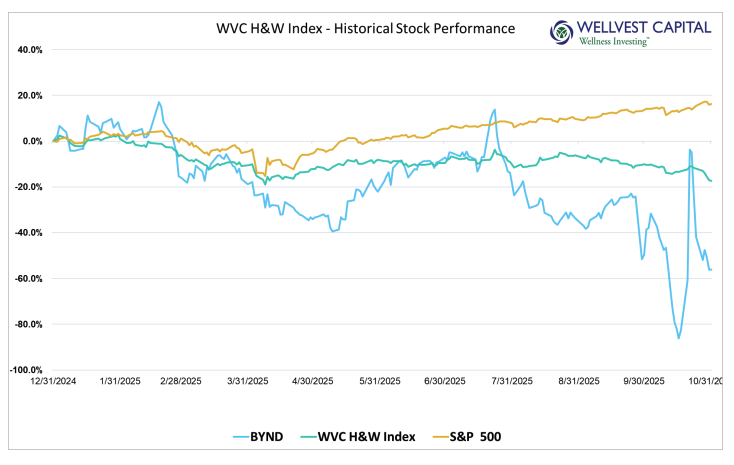

For the Wellvest H&W Index it was another “lather, rinse, repeat” month as the S&P500 grinded higher and the Wellvest H&W Index grinded lower. The H&W index once again lost ground to the S&P500 for the month, gapping to a negative 33.73% for the year. The H&W Index settled down 17.43% YTD, compared to the S&P 500 gain of 16.30% YTD, excluding dividends. Challenging to say exactly what is behind this poor performance. However, we all know that the AI trade is taking all the oxygen out of the room, reminiscent of the late 1990’s “dot com” era. Couple this with the mashup of tariffs, inflation, and the “K-shaped” economy and investors are pushing the health and wellness sector to the sidelines, at least for now.

This markets motto is reminiscent of the old US Postal service jingle about “rain nor snow will stop the postman”. It just keeps on rising higher regardless of what the financial weather is doing. It’s been an impressive bull market that seems to have no end in sight even with storm clouds approaching from all directions.

MORE FUN WITH THE FALLEN POSTER-CHILD

Last month we highlighted the uphill battle of Beyond Meat (BYND) from a fundamental business perspective. But in the fun and exciting world of meme stock investing, fundamentals just get in the way of a good time. During October, BYND stock went on a wild ride driven by the meme trading crowd. The stock hit a closing low of $0.52 on October 16, 2025, only to lurch upward over the next few trading sessions to a mid-month intra-day peak of $7.69 on the 22nd. A whopping 1378% gain over those few days! By the last trading day of the month the stock settled down to close at $1.66,

down 12.43% for the month.

In all fairness to these speculative pikers there was a thin veneer of drivers triggering the rally. The

company announced an expanded distribution deal with Walmart. While certainly a positive development; this does not guarantee velocity gains. Additionally, the company recently did a debt for equity conversion, helping to clean up the balance sheet but diluting the equity holders and crushing the stock to the delight of the short sellers. And lastly but most importantly the stock was added to the recently minted “Roundhill Meme Stock ETF”. Collectively this pile of dry straw was lit for a brief but impressive short squeeze. All of which just goes to show you that a busted clock is still right two times a day.

- Top Five Winners

|

|

|

|

|

|

|

|

|

|

- Top Five Losers

|

|

|

|

|

|

|

|

|

|

Data sources: Pitchbook

Copyright: Wellvest Capital 2025