HIGHLIGHTS

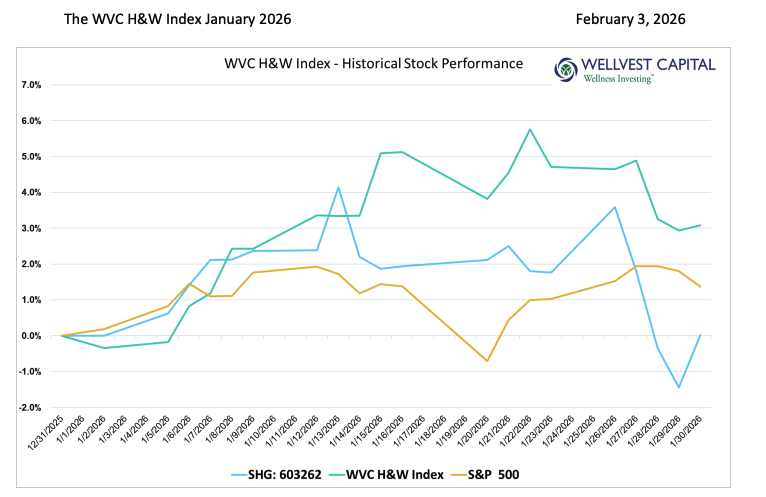

New year, new you! The Wellvest H&W Index was up 3.08% for the month of January as compared to

1.37% for the S&P500, excluding dividends. As regular readers will recall, the H&W index has struggled

to keep up with the blistering pace of the large cap bellwether index over the last many years. This

month’s outperformance can be attributed to the H&W Index winners smartly outnumbering and

besting the losers, with an average gain of 13.29% verses losses of 10.52% for the bottom dwellers.

While one month does not make a trend it is encouraging to see. How long this last is anyone’s guess.

Once again, the geopolitical narrative dominated market action. The month started with military action in Venezuela which proved to be a steppingstone to talk of annexation of Greenland. Only to be walked back at the global confab in Davos later in the month. These types of headlines typically create an overhang of anxiety in equity markets that can manifest itself in sharp, volatile price action across multiple asset classes. As witness in currencies and precious metals. This dynamic could open up advantageous entry points for long term health and wellness investors.

A NEW NAME

Once a year the constituents of the Wellvest Health and Wellness Public Company index are reviewed

to determine if any adjustments are warranted. Over the history of the index a handful of companies have been dropped due to bankruptcy, delisting, and take-private transactions while about the same number has been added as companies became public or are spun out of larger organizations.

Starting January 1, 2026, TSI Group Co Ltd (SHG: 603262) was added to the Index after going public

on the Shanghai Stock Exchange last July. The company is a global leader specializing in research,

development, and manufacturing of science-backed nutritional ingredients. Since its founding in 1996, the company has transitioned from a raw material supplier into a vertically integrated innovation partner, now serving as the world’s largest producer of HMB and a pioneer in sustainable, vegan glucosamine

H&W INDEX WINNERS and LOSERS – YTD as of January 31, 2026

- Top Five Winners

|

|

|

|

|

|

|

|

|

|

- Top Five Losers

|

|

|

|

|

|

|

|

|

|

Data sources: Pitchbook

Copyright: Wellvest Capital 2026