November 30 , 2022

VMS AS A PROXY

Back in October Wellvest wrote:

“Historically during these periods[of high inflation and a protracted economicslowdown]consumers have moved down market to more affordable offerings, including more value-oriented brands and private label. In other cases, they have reduced the volume of more expensive premium products and services.”

Recent retail data is supporting these statements, flashing caution, and validating “value” as the key driver of success going forward.

The health and wellness (H&W) sector isbroad and expanding in depth and offerings, daily.This level of scope is a positive for consumers and brands, but is challenging to quantify. Long before better-for-you food and beverages became mainstream, Vitamins Minerals and Supplements (VMS) were the mainstay for the emerging health and wellness sector. Today VMS continues to play a dominate role. VMS’s maturity and breadth of omni channel distribution makes it a natural proxy for the entire H&W sector. So, what is going on with VMS; how is the economy impacting it and what does this mean for health and wellness as a whole?

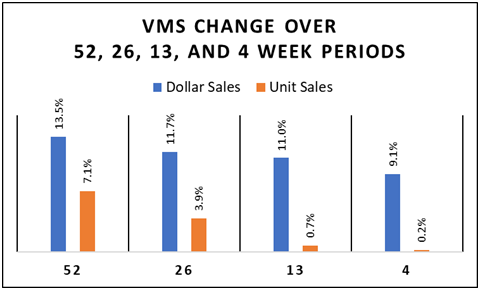

Chart is the percentage change over the same period a year ago

IRI and WVC proprietary data as of October 9, 2022

As reported,the pandemiccreated a large spike in VMS sales in 2020 and 2021, with immunity products leading the way. At the time Wellvestcharacterized this boostas a “Free BOGO”.The BOGO ended in 2022, andsales momentum has slowed considerably. While omnichannel (bricks and mortar retail and ecommerce)dollar sales over the last 52 weeks(for the period ending October 9, 2022*) shows a strong 13.5% increase in sales over a year ago; the shorter periods of 26, 13 and 4 weeks show considerable slowdown in growth. Dollar growth in Omnichannel over these periods was 11.7%, 11.0% and 9.1% respectively. From the view of dollar sales near term growth rates still look healthy but waning. While thisdecrease is cause for pause, categoryresilience in VMS is not unprecedented. During the “Great Recession” of 2008-2009, VMS sales slowed but still experiencedstrong single digit growth bucking the economic trend at the time.

In a high inflationary environment, dollar sales alone do not tell an accurate picture of category growth and consumer demand. Unit volume needs to beconsidered along with average price. VMS unit growth over the same periods, 52, 26, 13 and 4 weeks has been much slower than dollar growth; 7.1%, 3.9%, 0.7% and 0.2% respectively. Effectively VMS unit volume has stopped growing over the last few months; almost all the growth has come from price increases.

An additional level of analysis of these numbers starts to provide valuable insights regarding consumers behaviors and pricing. The spread between the growth rates in dollars versus units indicates the average selling price. The 52 week spread is 6.4%, 26 week is 7.8% and 13 week is 10.3%, which means that on average VMS prices have been dramatically increasing. This is consistent with the overall Consumer Price Index (CPI) during this same time period. Interestingly the 4-week spread is 8.9% which is a meaningful drop from 10.3% over the 13 weeks. Retail sales numbers over 4 week periods are notoriously volatile due to promotions, inventory timing and other short term impacts, but in this case the 4 week numbers is potentially a leading indicator ofprice action.

The data indicates that over the last month the average prices for VMS products have come down. There are only two drivers of the average price; the price brands and retailers charge consumers (be it everyday price and/or discounted price) or a change in the mix of products – movement from higher price brands to lower or vice-versa. If prices don’t change and unit volume does not change, but average price increases this means that consumers purchased more expensive products as compared to prior periods.It’sdifficult to pinpoint exactly what is driving the recent decline in VMS average pricebut it’s not necessary. Regardless, consumers are no longer willing and/or able to absorb endless price increases. They are no longer purchasing more units and the ones they do are at a lower price. That lower price could be from promotions, discounts on repeat purchases or trading down to lower priced alternatives. Bottom line: VMS demand at current price points is falling in the near term.

VMS “FEAR” DRIVEN DEMAND IS WANING FAST

PRIVATE LABEL – THE CANARY IN THE COAL MINE

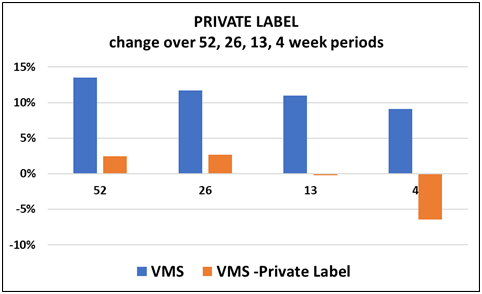

IRI and WVC proprietary data as of October 9, 2022

Conventional wisdom and past economic downturnslead one to believe that slowing growth due to price pressure in the VMS category would likelylead to relative out performance in private label which is usually in a top market share position due to its lower cost. Recent retail sales data suggests otherwise, as private label has been lagging the overall category by a considerable amount. Dollar salesretreated from very slow growth to negative growth, from +2.5% the last 52 weeks to -6.5% in the last 4 week period. Unit sales are contracting across all periods, from -3.5% to-12.1% over 52 and 4 weeks respectively. The average price pattern is the same as the overall VMS category discussed above just at a lower nominal level.A more granular view of the data shows what everyone alreadyknows, Amazon and ecommerce in general is rapidly taking VMS market share from bricks and mortar retailers. This is having an outsized impact on VMS private label with the retail channel greatly under performing with negative growth across the board over all periods in both dollars and units. Intuitively this makes sense since private label sales are heavily weighted to in-store shopping.

What is driving the weakness in private label and why does it matter? The large spike in VMS demand due to the COVID pandemic (2020-2021) brought new shoppers to the category, “marginal consumers”. These consumers spent incremental dollars that drove up retail sales. Existing VMS consumers continued to follow their normal purchasing habitsbut many added immunity products as well. Given the economic uncertainty and high unemployment at the time,

VMS GROWTH STILL STRONG BUT SLOWING DOWN

PRIVATE LABEL FEELING THE LOSS OF MARGINAL CONSUMERS

we believe the marginal consumers naturally gravitated to value brands including private label.Fast forward to 2022, the “fear” driven use of supplements has waned as vaccinations came online and the pandemic is no longer top of mind. Enter in high inflation and economic uncertainty without federal financial support and these new “marginal consumers” are the first ones to drop out of the category. Bottom line: The fast-rising tide of 2020-2021 that lifted all boats, especially the inexpensive ones in private label, is now receding.

“VALUE”DOES NOT ALWAYS MEAN CHEAP

Consumer behaviors are changing rapidly as reflected in the weak financial performance of major retailers like Target, Walmart, and others. The retail level sales data for VMS aligns to this with Private Label leading the pull back. As a key category within the greater health and wellness sector, VMS’s slowdown is indicative of what can be expected across the sector.This is consistent with the historical pattern of health and wellness getting weaker, but not crashing, during times of economic stress. As witnessed in the VMS numbers which continue to show strong single digit growth just not at the same robust pace of recent periods.

Value is the key driver for market participants in the health and wellness sector and will remain so until this period of economic uncertainty is far behind us. Delivering on great value and health will prove to be the winning combination. Great value does not always mean the lowest cost; it means providing “more bang for the buck”.Delivering on the value proposition will result in increased unit sales, greater velocity, and higher customer loyalty. For management teams and their investors, unit sales should be the critical metric to define success and progress going forward. Revenue growth attributed to only taking price, excluding the impact of product mix, should not be met with a celebration but caution.Bottom line: keeping up with inflation is not growth and does not add long term value to the business.

ITS ALL ABOUT VALUE NOW

UNIT SALES DEFINE SUCCESS GOING FORWARD

Coil the Spring – be prepared

The Health and Wellness sector was built on the thesis that having choices that support and sustain health and wellness in all its forms is a net positive for all stakeholders. Over a long period of time consumers have grown to trust the companies and brands that fulfill this promise every day. In times of economic uncertain that trust will be tested as consumers will expect market participants to continue to deliver on this promise including prioritizing economic value. Brands, retailers, and suppliers that continue to deliver the “same great product at the same great value” will be rewarded in the long run. Cementing customer loyalty and building market share.Now is the time to position yourself on the side of the consumer to nimbly avoid the pricing backlash that is sure to be just around the corner.

*Source: IRI and Wellvest Capital proprietary data

For more information on this topic please visit our website for these relevant articles:

How the Economy Impacts Health and Wellness – Wellvest Capital

Now What? Health And Wellness After The Covid Spike – Wellvest Capital