Feb 3, 2021

Given everything that happened in 2020, many business owners have found themselves thinking about the potential timing and preparation for selling or exiting their companies. Some business owners have had to delay timelines for a sale due to the impact of COVID-19 on financial performance. Others have been jolted out of complacency with the realization that the unpredictability of life events should be planned for today to maximize flexibility in decision making around future transactions for their business. And to complicate matters further, many owners are trying to sort through these important questions under the pressure of potential changes to tax policies and rates as proposed by the Biden Administration. Increasing the capital gains rate, for example, will directly impact a seller’s net proceeds from a sale transaction.

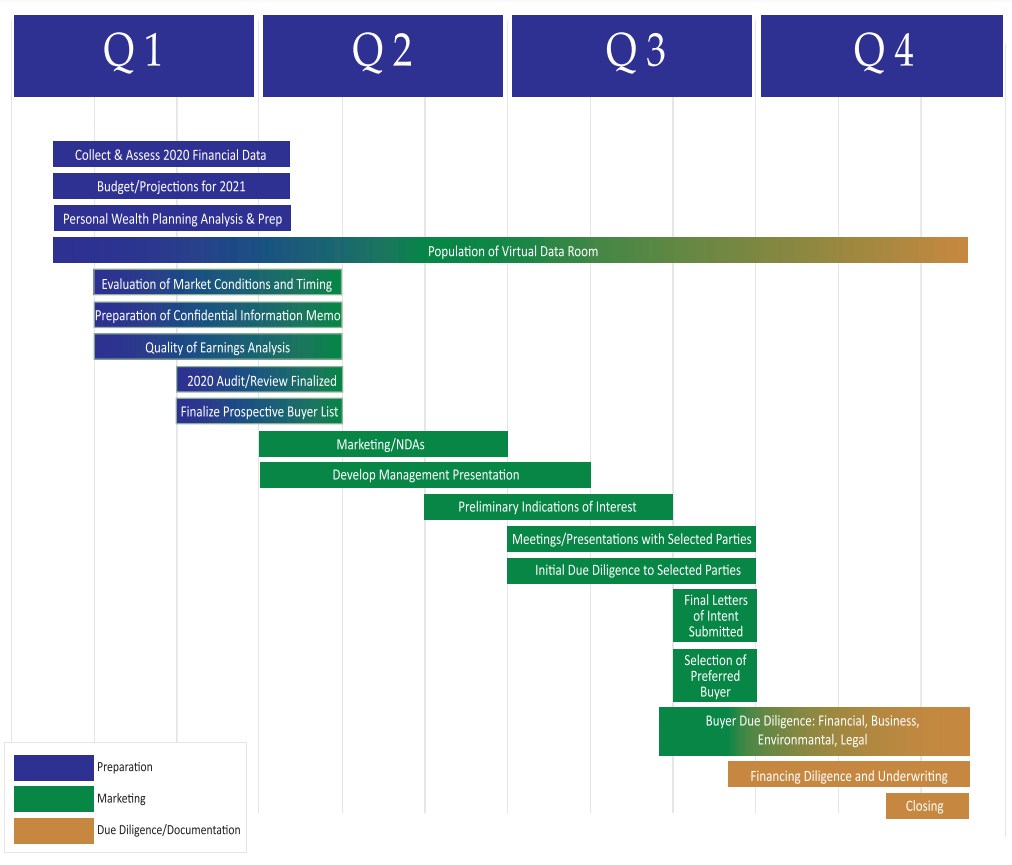

After decades in the M&A industry and a close watch on more recent market trends, we strongly suggest that whether you’re thinking about selling soon or looking to develop an actionable timetable for a sale in the future, proactive preparation for a business sale should start now. In fact, if you have the desire to close a transaction before year-end 2021, in order to run the type of process likely to close with the best price and terms you should be working on this project in earnest before the end of Q1.

Likely Process for Start-to-Finish 2-Stage Competitive Sale in 2021

The first two questions that you need to ask:

- Should I think about selling soon?

- Is my company prepared enough to execute a transaction now?

If answering yes to the first question, you need to assess how your business was impacted by COVID-19, and how the pandemic affected your financial performance. For this, you will need detailed monthly financial data and, ideally, management reports/KPIs going back to, at least, the beginning of 2018. This will give you the concrete metrics for an overview picture of how the business was impacted, when it began to recover, and when it did or will return to pre-pandemic run rates.

Once you have the above documents in place, you’ll need to quantify the impact the pandemic has had on performance for each month since March 2020 in comparison to previous years in order to establish trendlines that can be evaluated. If your business has recovered to pre-pandemic trendlines, you can identify the “Pivot-Point” where any unusual impact (both positive and negative) returned to the normal run rate. Or, if your business model/trajectory has permanently shifted due to circumstances surrounding COVID-19, assess when the “new normal” was reached. Alternately, if your business has not yet returned to a normal financial baseline, use your monthly reports to evaluate monthly progression since March to establish the reporting criteria you need to accurately predict when you reasonably expect to hit your Pivot Point.

Based on current trends and run rates, you should be able to develop a reasonable forecast for 2021 financial performance. Once you have a good understanding of the trends and dynamics that broadly effect your industry, along with the potential strategic buyers who are focused on your market, you can evaluate whether the audience will likely be receptive to a transaction that can deliver your desired outcome. If you do launch a sale process in the near term, be sure to keep in mind that the magnitude of impact that COVID-19 had on your financial performance is likely to have a direct impact on the valuation and/or structure of a sale.

If you are not in a position to pursue a sale transaction in the near future, taking the following action steps will allow you to best evaluate when an attractive sale opportunity will arise:

- Develop and compile all of the data, reports, and documentation referenced above.

- Set up a Virtual Data Room to store this information in a secure and readily accessible way.

- Establish the internal procedures, protocols, and processes necessary to have all of this information updated every month during the ordinary course of your month-end closing process.

- Start identifying who the likely suitors for your business may be and track their news announcements.

- Work with a financial advisor to understand exactly how the value of your business fits into your personal estate plan, and how it will contribute to your financial well-being over the longer term; identify goals and objectives that might be achievable under different growth scenarios and/or exit timetables.

- Make sure to speak regularly with investment banking, legal, and accounting professionals who focus on the M&A market to maintain a clear understanding of what your business is worth and what factors may impact the value or structure of your company now or in the future.

If you are interested in a potential sale before year-end 2021, now is the time to get organized. Businesses are sold in many different ways and transactions completed in shorter timeframes, but in order to run the tried-and-true process to achieve the best price and terms, you must be prepared, you must create competition, and this process can take several months.

And even if you are not necessarily considering a sale in 2021, establishing key internal processes, procedures, and reporting systems critical to a successful transaction process is simply a good business practice. Doing these things will increase the value of your company and make the due diligence process go smoothly with the buyer.

If you have any questions or need guidance in helping to plan and prepare your business for sale, don’t hesitate to reach out – we would be happy to be of assistance.