POLITICS PUTS HEALTH AND WELLNESS IN SPOTLIGHT

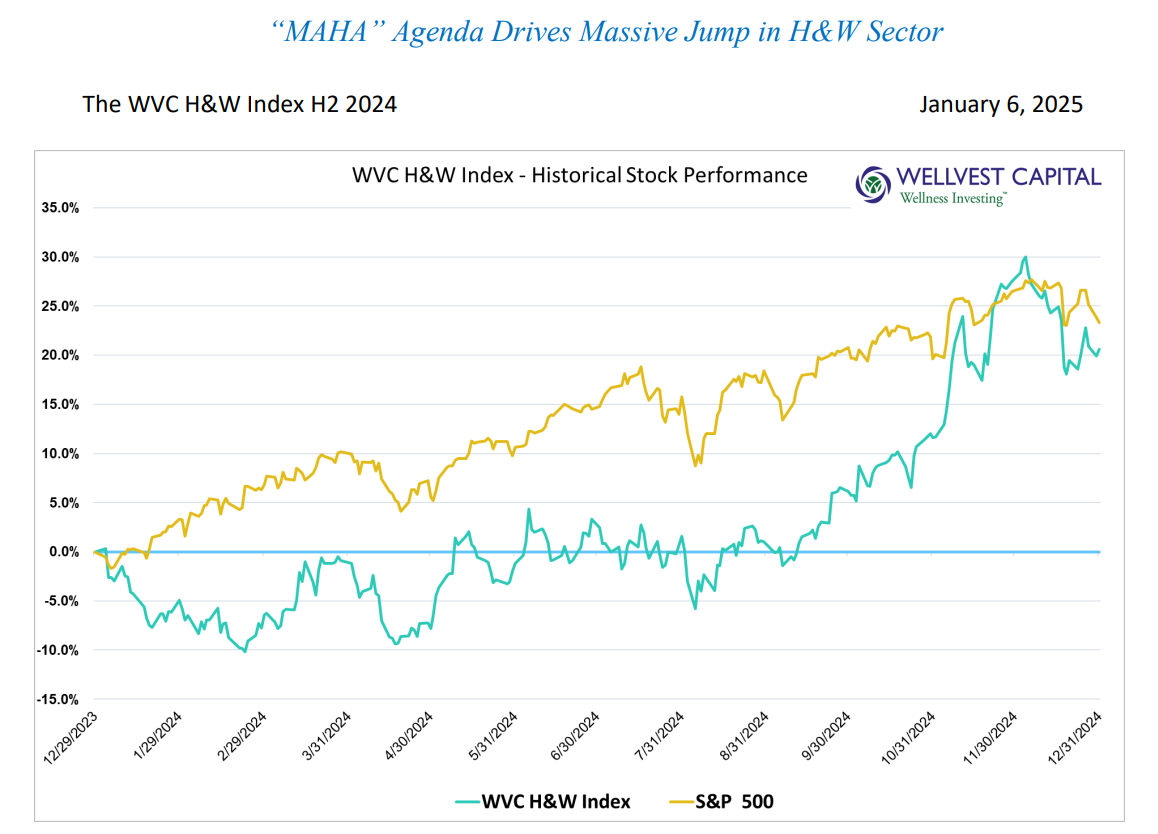

For most of the second half of 2024 Wellvest Capital’s Health and Wellness Public Index (WVC H&W Index) generally followed the dance steps of the S&P 500. Heading into the peak of the Presidential election the tenor changed dramatically, generating a sharp rise in the WVC H&W Index with a huge gain in November due to the Trump win and the administrations “Make America Healthy Again” (MAHA) agenda. After many years of significantly lagging the S&P 500, the WVC H&W Index beat the S&P500 over the second half of the year and was just short of matching it for the entire 2024 period. For the year our WVC H&W Index was up 20.60% as

compared to the S&P 500 increase of 23.31%, excluding dividends.

Looking back over the last six months, the Presidential election is top of mind. The pro-business policy agenda had a major influence over the S&P500 starting with the dominate election win for former President Trump. This kept the bullish momentum going all the way into the very last days of the year. Prior to the election the large cap index was captive to Chairman Powell’s views on the direction of interest rates, earnings surprises and geopolitical risks. And let’s not forget the Yen driven micro-flash-crash in August when the S&P500 had a nasty draw down of ~8.5% from its late July peak of 5,667. This spike down was dominated by a HUGE increase in volatility with the VIX up to 65+, a level not seen since the very early days of COVID. Regardless of this and other various hiccups along the way, “all’s well that ends well” for the bulls in 2024.

MAHA IMPACT AND IMPLICATIONS

The MAHA platform has sparked a national conversation on reforming how the Government approached the health and wellness landscape, influencing food, beverage, personal care, and pharmaceutical sectors. The movement emphasizes the importance of diet and exercise in improving overall health, a message long championed by the health and wellness industry. The increased attention, fueled by the recent presidential election, has the potential to reshape consumer behaviors and regulatory landscapes. MAHA’s vision includes reducing harmful food additives, potentially aligning U.S. standards closer to Europe’s more stringent regulations, and promoting fresh, minimally processed foods. If implemented, these changes could significantly disrupt the food and beverage industry. Established giants like Nestlé, PepsiCo, and Mondelez

International, whose portfolios are dominated by processed and additive-rich products, stand to lose market share. Meanwhile, smaller health-focused brands such as Simply Good Foods, Vital Farms, and Zevia are well-positioned to benefit. This was not lost on market participants, as many stocks in the H&W sector saw outsized moves. For instance, Zevia’s stock surged by 74.4% in November, while Natural Grocers saw a remarkable 71.8% increase. Other health-focused companies like Sprouts Farmers Market and United Natural Foods also experienced gains of 20.4% and 22.1%, respectively in November. On the flip side, most “Big Foods” names dropped in value.

The potential for regulatory shifts, such as reducing allowable food additives from 3,000 to 400 or mandating warning labels on unhealthy foods, could radically alter the market. Government programs like SNAP and WIC may prioritize providing only healthy, clean-label foods. Such changes would create immense pressure on legacy companies while driving demand for healthier alternatives. These shifts could also trigger a wave of mergers and acquisitions (M&A) as traditional “Big Food” players adapt by acquiring innovative, health-focused brands. Depending on the speed and scope of regulatory changes, this M&A activity could occur rapidly, creating a dynamic market environment.

WVC H&W INDEX SPRINGS TO LIFE

The shake out in the health and wellness sector that has been undergoing for the last few years appears to have reached its nadir in H2 2024. From about mid-year forward early green shoots started to gain serious momentum as once nearly dead stocks rose back to life. This group benefited from management finally executing on delivering profitability. Standouts include Peloton (PTON), which had a great year up 42.9%, Laird Superfood’s (LSF) turnaround resulted in an astronomical 765.9% stock price increase, and Zevia (ZVIA) more than doubling, jumping 108.5% for the year. Under the hood, the WVC H&W Index looks rather healthy. While the number of winners, 20, was behind the number of losers, 27, the winners’ average return of 101.1% far out shined the losers’ -39.0% loss. At the extremes, the top 5 stocks return 265.7% on an equal weighted bases with the bottom 5 losing 83.2% on the year. From a valuation perspective the WVC H&W Index sits at a 28x trailing twelve months PE and 21 next twelve months PE which is generally in line with the broader market.

For all the chatter, hand wringing and prognosticating about the famous “Magnificent Seven”, their 2024 results pale in comparison to the “H&W Mag Seven”! The legendary Mag7 returned 63% in 2024 while the top 7 in the WVC H&W Index generated an exceptional 217%. Of course, on a longer timeline the real Mag7 has beat the stuffing out of the WVC H&W Index, however the recent change of fortune is an intriguing indicator and outstanding example of a catalyst lighting a fire to dry powder.

Coil the Spring – be prepared

For the first time in many years the WVC H&W Index beat the S&P500 over the last six months. The underlying foundation of this turnaround was a renewed focus on profitability and the return to sound business models. This set the stage for the explosive move up generated by the Presidential election. The second half of 2024 was a pivotal moment for the health and wellness sector. The MAHA narrative has put a spotlight on health and wellness and has already had an impact as witnessed in the extreme movement of individual company stock prices. As 2025 unfolds, brands, investors and market participants need to be ready to act, invest and possibly pivot to quickly adapt to changes to government policy and regulations. For investors, now is the time to choose where to invest, which themes to play and which companies offer the best opportunity for above market returns. The next six months could be dramatic, with the potential for once-in-a-generation opportunities for those ready to take advantage.

About WELLVEST CAPITAL’S HEALTH AND WELLNESS PUBLIC COMPANY INDEX

In 2021 with the intention of capturing the new health and wellness investment dynamic, Wellvest Capital created our proprietary “Health and Wellness Index” (WVC H&W Index). This index is comprised of approximately 50 US publicly listed companies of all capitalizations that are active participants in the health and wellness industry providing a wide range of goods and services. Being a rapidly evolving sector with many emerging small-capitalized businesses competing with legacy large cap companies, the index utilizes an equal weighted calculation methodology. Better-for-you food and beverages, vitamins & supplements, fitness apparel and equipment, ingredient suppliers and weight loss are characteristic of the categories included. Beyond Meat, Lululemon, Oatly, SunOpta, Nestle, The Honest Company, Sprouts Farmers Market, and Peloton are representative of the group.

We would love to hear from you.

David Thibodeau

david@wellvestcapital.com

Rob Rafferty

rob@wellvestcapital.com

Please visit Wellvest’s library of insights and articles at wellvestcapital.com/newsroom

Data sources: Pitchbook, Standard and Poor’s

Copyright: Wellvest Capital 2025