HIGHLIGHTS

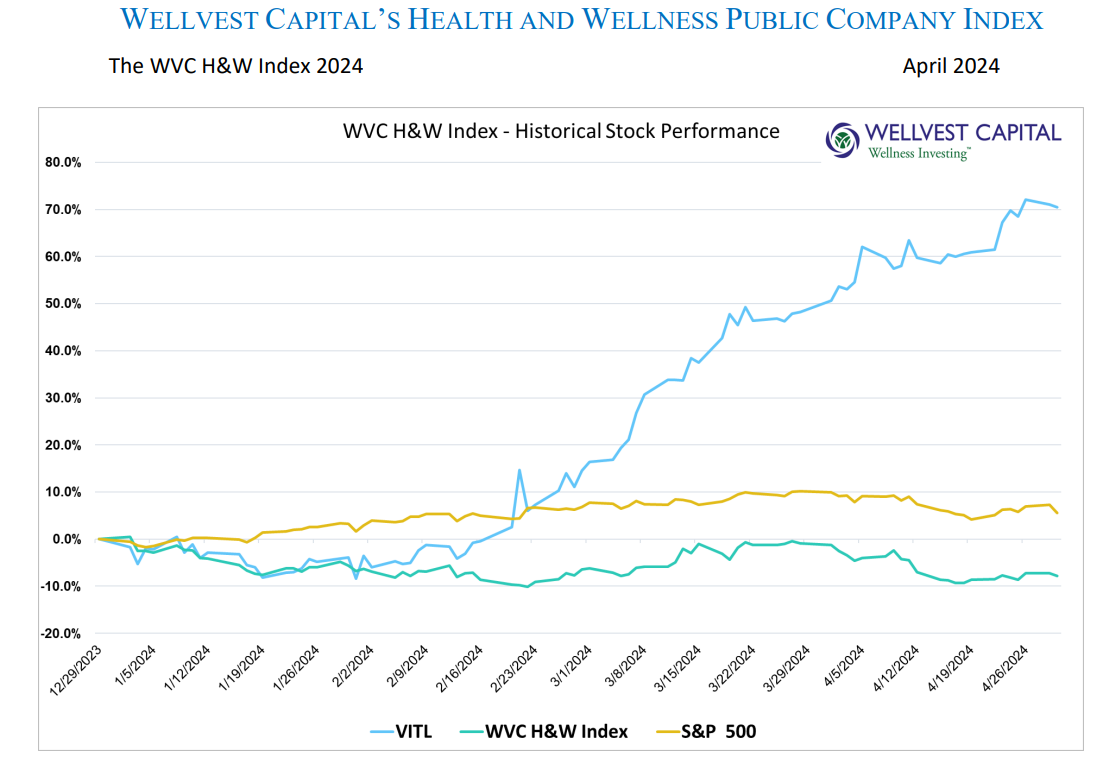

“April is the cruelest month” is a good description of what just transpired over the last four weeks with the S&P500 down 4.16% for the month reducing the YTD gain to 5.57%. While T.S. Eliot was not concerned with the stock market, April is historically a weak month. Many prognosticators attribute this to the fact that taxes are due, resulting in decreased savings and negative sentiment. The Wellvest H&W Index didn’t buck the trend, giving up 7.31% for the month, bringing the YTD loss to 7.84%.

Besides economic data, Earnings are exerting tremendous influence of the markets, as readily witnessed with mega-cap tech stocks. Closer to home, Vital Farms (VITL) is a prime example, reporting earnings in March that beat consensus. Forward guidance was also positive, resulting in a steady increase in stock pric generating 70.4% YTD.

UNDERLYING VOLATILITY

The average loss for the losers in the WVC H&W Index for the month of April was 10.85%, with the winners up a modest 6.81%. Underlying these averages was significant volatility. A number of companies were down over 20%, including Medifast (MED) down 28.16%, Peloton (PTON) down 27.42%, The Honest Company (HNST) off 25.56, Zevia (ZVIA) decreasing 26.42%, Xponential Fitness (XPOF) down 22.91%, and United Natural Foods (UNFI) giving up 22.28% for the month. The increase in the winners’ group was much more muted. Lifeway Foods (LWAY) was the runaway gainer with a 18.76% pop, followed by Vital Farms (VITL) up 15.01%, Shimano (TKS:7309) increasing 10.07%, and GrowGeneration (GRWG) pitching in a 4.55% gain. The negative sentiment is clearly dominating the streets view of health and wellness companies. At this rate, there will be some exceptional buying opportunities once a bottom is put in.

H&W INDEX WINNERS and LOSERS – YTD

- Top Five Winners

|

|

|

|

|

|

|

|

|

|

- Top Five Losers

|

|

|

|

|

|

|

|

|

|

Copyright: Wellvest Capital 2024