HIGHLIGHTS

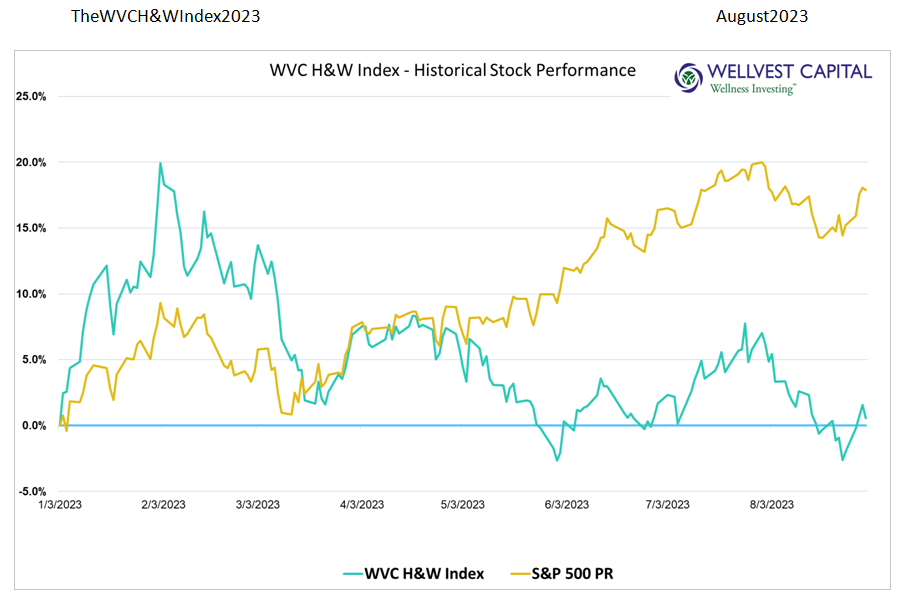

In August, the WVC H&W Index gave back much of the ground it had gained relative to the S&P500. The WVC H&W Index returned a negative 6.45% for the month, dropping the YTD performance to a positive 0.57%, excluding dividends. The S&P500 lost 2.13% in August bringing down the YTD gain to 17.87% for the period ending August 31, 2023, excluding dividends. From a valuation perspective, the WVC H&W Index has a forward P/E of 23.1 which is modestly higher than the S&P500 forward P/E of 20.05.

A “sloppy” August did no favors for the WVC H&W Index on an absolute basis and relative to the S&P500. The market action was choppy, seasonally low trading volume and profit taking before September set a negative backdrop. Earnings drove outsized moves in individual stocks while the interest rates story continues to hold center stage. It’s unlikely September and October will be quiet months, expect the unexcepted.

A MIXED BAG OF DRIVERS

A few of the stocks in the WVC H&W Index had some eye-popping moves both on the upside and the downside. From earnings surprises to takeovers to short squeezes, there was no shortage of fireworks. Thorne Research (THRN) was up over 69% for the month of August due to the take private bid by L Catterton at $10.20 a share. Blue Apron (APRN) had a 59% month over month stock price increase. Speculation is that a short squeeze was driving it up. Lifeway Foods (LWAY) had a strong earnings beat resulting in a 63% pop for the month and an impressive 94% gain for the year. On the flip side, Peloton (PTON) earnings failed to meet the street’s expectations with the stock losing nearly 35% of its value, even after a modest rebound in the last few days of the month. Lastly, we have Smart for Life (SMFL) which has the enviable honor of having another reverse stock split, the second this year! This time was a3:1 reverse split, resulting in a 37% loss for the month of August and over 89% loss for the year; not too smart.

H&W INDEX WINNERS and LOSERS – YTD

- Top Five Winners

- Thorne Research (THRN) 179.1%

- WW International (WW) 151.6

- Lifeway Foods (LWAY) 93.7

- BellRing Brands (BRBR) 61.9

- Natural Health Trends (NHTC) 57.4

- Top Five Losers

- Smart of Life (SMFL) -89.2%

- Honest Company (HNST) -50.8

- United Natural Foods (UNFI) -48.0

- SunOpta (SOY) -47.6

- Nu Skin Enterprises (NUS) -43.3

Data sources: Pitchbook, Y Charts

Copyright: Wellvest Capital 2023