HIGHLIGHTS

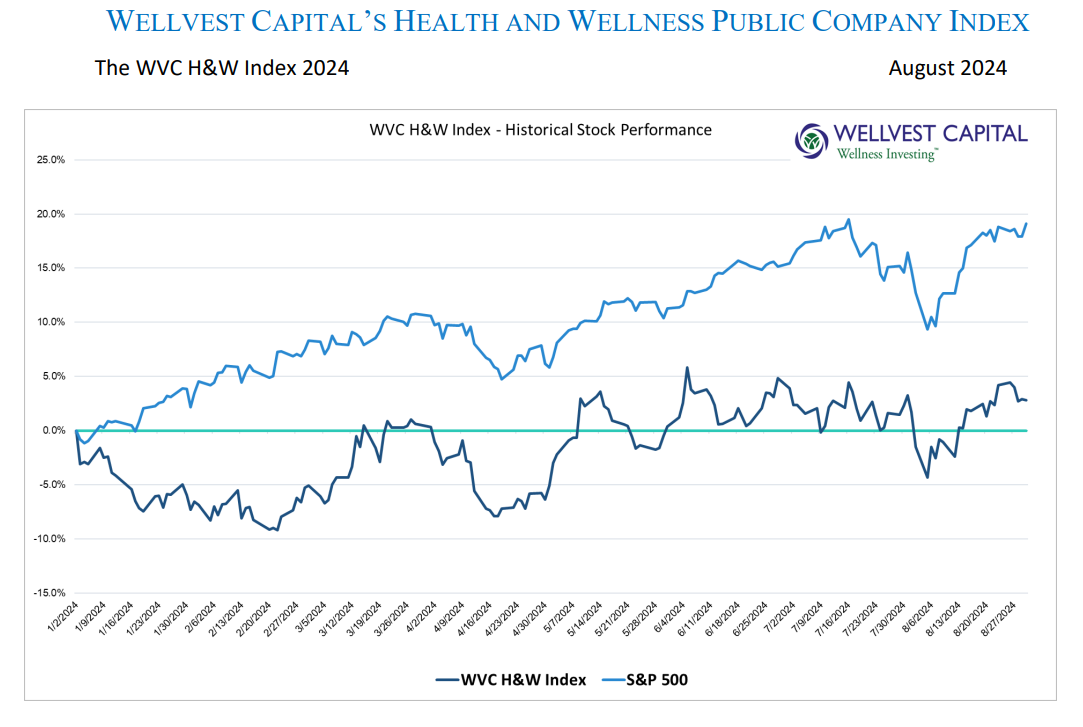

If you were on the beach in early August, you missed it! The S&P500 started with a nasty draw down of ~8.5% from its late July peak of 5,667. The spike down during the first few days of the month was dominated by a HUGE increase in volatility with the VIX up to 65+, a level notseen since the very early days of COVID back in 2020. This was over as quickly as it began, with the S&P500 finishing the month up 2.28% and 18.42% YTD, excluding dividends. The WVC H&W Index followed these same dance steps, with a big down leg early in the month only to recover to a small YTD gain of 2.83%, excluding dividends.

The mini-crash of the Japanese stock market, down 12% on August 5 and the enormous spike in the VIX, deserves some reflection. While the market has recovered and the “Mag7” continue on their merry way, the tremors from early August should not be ignored. This could be an early indication that under the surface things may not be right in the global financial markets. Stay vigilant.

FILLING THE GAP

Not so long ago, Whole Foods was the launching pad for innovative brands in the health and wellness space. Their selection criteria for natural foods, beverages and CPG to be clean label, transparent and sustainable leaning, set the standard for the rest of the industry. Over the last decades the “natural” channel has been integrated into the traditional grocery. Sprouts Farmers Market (SFM) appears to be the new Whole Foods, taking the mantel as the go-to retailer for today’s emerging challenger brands. The stock’s performance for the year is outstanding, up 116.3% handily beating the S&P500 and its peer group. Natural Grocers is also outperforming, up 66.4% YTD through August 31, 2024.

H&W INDEX WINNERS and LOSERS – YTD

- Top Five Winners

|

|

|

|

|

|

|

|

|

|

- Top Five Losers

|

|

|

|

|

|

|

|

|

|

STAY VIGILANT

Eyes wide open as we enter the last trimester of 2024 given the many land mines ahead including a very stretched consumer, a Presidential election, and serious geopolitical issues. A bright spot may be the Fed reducing interest rates beginning in September.

Copyright: Wellvest Capital 2024