HIGHLIGHTS

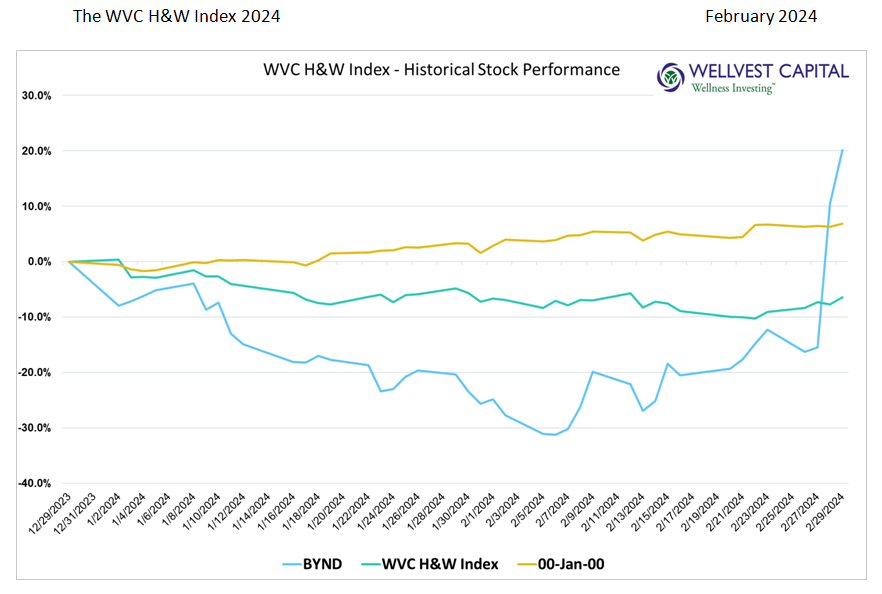

The S&P500 continued its strong start to the year with a 5.17% gain for the month bring the YTD return to 6.84%, excluding dividends. The Wellvest H&W Index delivered a modest gain, bringing the YTD loss to 6.41%, up 1.11% for the month. Two narratives are driving the markets that appear to have equal attention from investors. The now long-in-the-tooth macro stories of inflation, geopolitical uncertainty and a resilient consumer are being counterbalanced by company level fundamentals. The market is significantly bidding up stocks that beat earnings forecasts and crushing those that don’t; could be a sign of a healthy market.

EARNINGS MATTER

Earnings reports had a heavy influence on the stocks in the WVC H&W Index, generating some exhilarating volatility! The upside surprises, good for the Bulls, not so good for the Bears, included Sprouts Farmers Market (SFM), Fresh Pet (FRPT), and Celsius Holdings (CELH). SFM’s earnings beat pushed the stock to new highs and YTD return of 29.7%. FRPT, +30.3% YTD, is stringing together multiple quarters of consistent growth and profitability. CELH enjoyed an upwards spike on positive earnings, squeezing the shorts. On the flip side, Blowflex (BFX) is facing a cash crisis due to large operating losses crushing the stock. Prior Wall Street darling, WW International (WW), -64.5% YTD, has fallen from grace and the outlook is not good. Oprah’s departure from the board was a significant factor in the decline. Another GLP-1 casualty, Medifast (MED), has come under pressure as investor question the legacy business model in light of the dramatic changes in the weight management category. Bottom line; fundamentals matter and nimbly adapting to a changing world is just as important.

H&W INDEX WINNERS and LOSERS – YTD

- Top Five Winners

|

|

|

|

|

|

|

|

|

|

- Top Five Losers

|

|

|

|

|

|

|

|

|

|

Please visit Wellvest’s library of insights and articles at wellvestcapital.com/newsroom

Data sources: Pitchbook. Copyright: Wellvest Capital 2024