HIGHLIGHTS

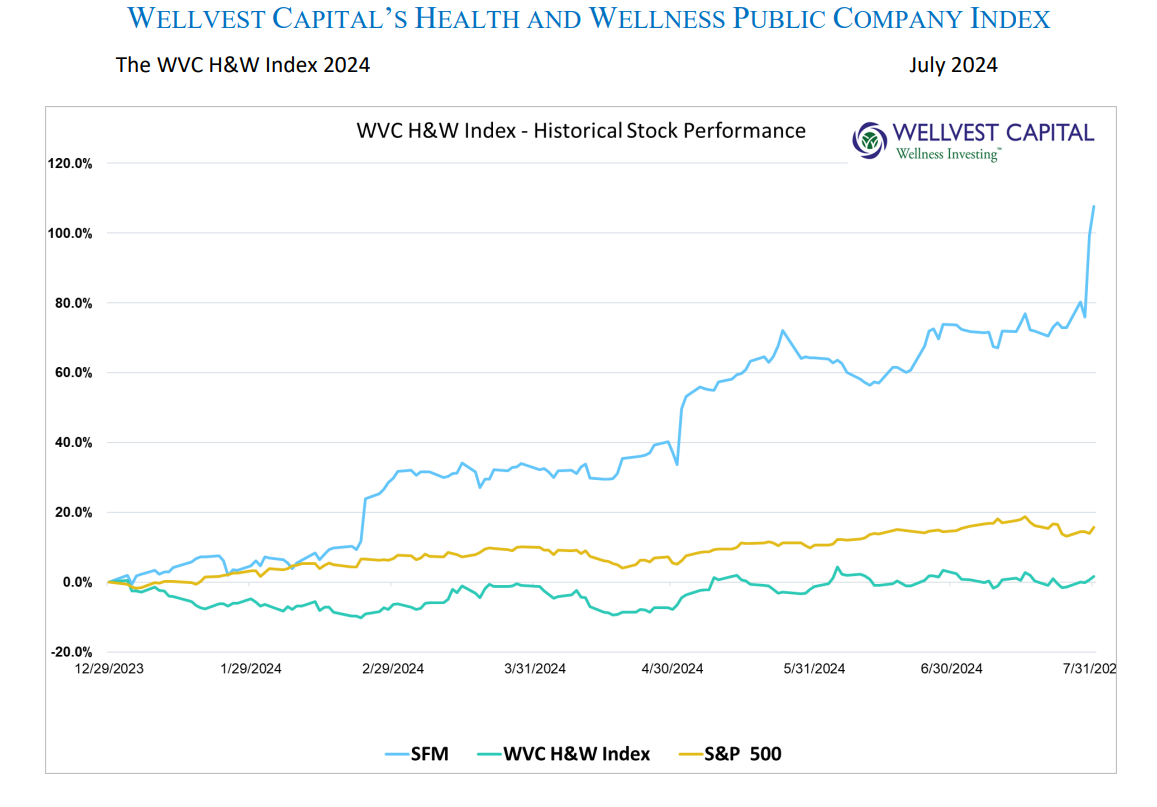

The Wellvest H&W Public Company Index faded in July, going down 1.91% for the month bringing the YTD return to a positive 1.62%, excluding dividends. The S&P500 had a volatile month but ended with a 1.13% gain adding to a strong year, YTD 15.78% excluding dividends. The H&W Index has a few bright spots with Sprouts Farmers Market (SFM) serving up a healthy upside earning surprise which was good for 13% pop on the day, bringing YTD to 107.6% increase. The stock is a promising proof point of consumers’ demand for healthier foods remaining strong.

July market’s action was dominated by the rotation out of megacap tech and into small caps; for the WVC H&W Index the story was more of the same. The top-tier stocks that continued to deliver on earnings were rewarded handsomely with the bottom-tier losers grinding lower as investors lost confidence. Fundamentals are in the driver seat for the time being, with interest rates and politics to take the wheel very soon.

INVESTORS WAITING FOR THE PROOF

The old saying “the proof is in the pudding” is ringing true for health and wellness companies. Over the last few years, many formerly read hot on-trend companies have had to fundamentally change their business models as investors soured on funding endless red ink. Management reacted by announcing major plans to address past defiance’s. Plant based protein and alt-milk are the poster children. On this news, the Street gave many the benefit of the doubt and lifted the stocks. As these plans stretch further into the future, investors have once again grown impatient, driving down valuations. While we would love to see these innovators succeed, it’s worrisome to think what could happen to them in the next bear market. We’ll keep you posted.

H&W INDEX WINNERS and LOSERS – YTD

- Top Five Winners

|

|

|

|

|

|

|

|

|

|

- Top Five Losers

|

|

|

|

|

|

|

|

|

|

Copyright: Wellvest Capital 2024