HIGHLIGHTS

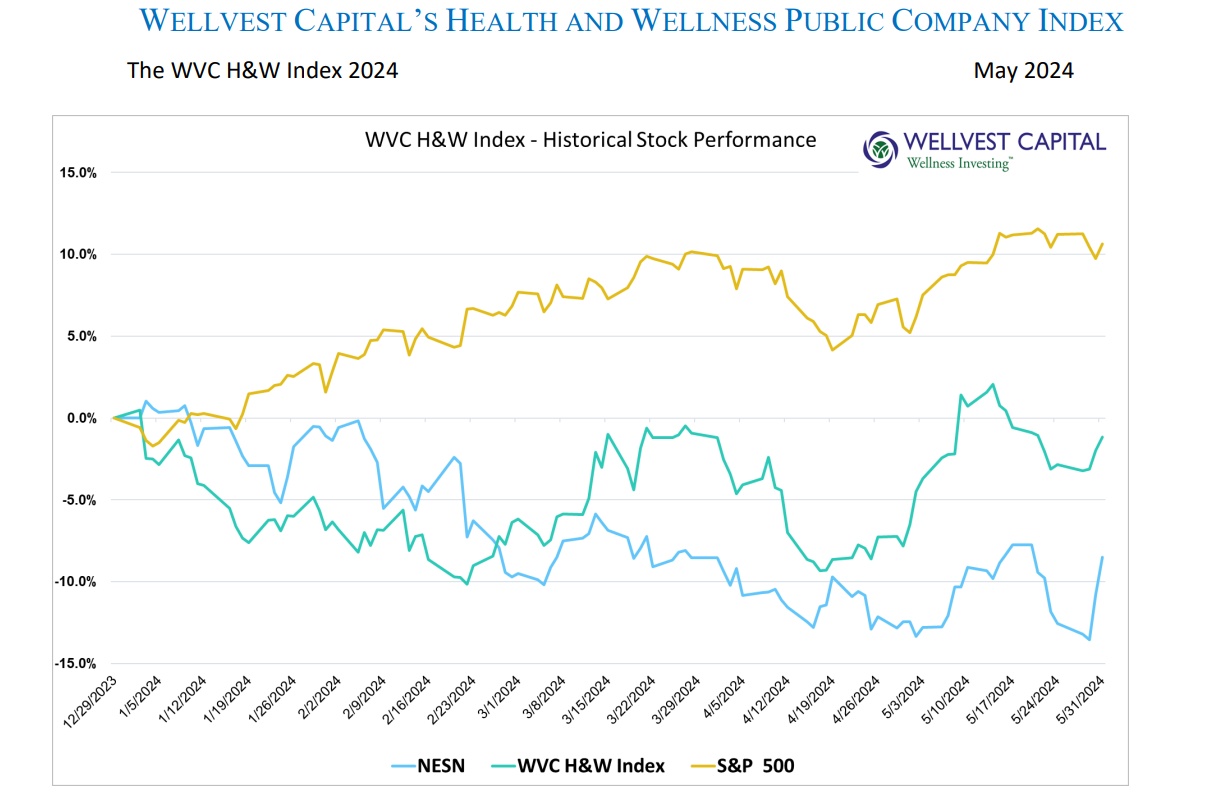

The Wellvest H&W Public Company Index made a long-awaited comeback delivering a 6.71% return for the month vs. the S&P500 4.80%, excluding dividends. The index was buoyed by a few outsized winners including Vital Farms (VITL) with a 54.75% gain, Laird Superfood (LSF) caulked up an eye popping 40.21% rise and a strong performance by the food distribution/retailers United Natural Foods and Natural Grocers who chipped in 34.49% and 31.91% respectively. This time around the losers, 17 in total, did not overwhelm the winners, down 9.14% as a group for the month.

This month, bargain shopping in the health and wellness bin was a good move as the WVC H&W Index outperformed its tech-heavy large cap brethren, (S&P 500) by 1.91%. With all the noise, choppy economic data, the turn to summer and the not too far off presidential race, it’s anyone’s’ guess what will happen next. Were placing our bets on uncertainty

BELLWEATHER NESTLE’

On May 17th, Andew Barry from Barron’s penned an informative piece on Nestle (SWX: NESN). This company continues to struggle as it very slowly transitions from a legacy “big food” company to a nimble health and wellness innovator. Barry leads by calling out the drop in unit volume of 2% vs. pricing up 3.4%, “amid consumer pushback against sharply higher food costs.” The pivot to health and wellness has been achieved via acquisitions, including Nature’s Bounty and Freshly, along with many smaller deals. The move into nutrition is a net positive although the Freshly prepared-meal business was a “bomb”. It’s been a rough ride for the stock; down 8.50% YTD after a challenging 2023.

H&W INDEX WINNERS and LOSERS – YTD

- Top Five Winners

|

|

|

|

|

|

|

|

|

|

- Top Five Losers

|

|

|

|

|

|

|

|

|

|

Copyright: Wellvest Capital 2024