HIGHLIGHTS

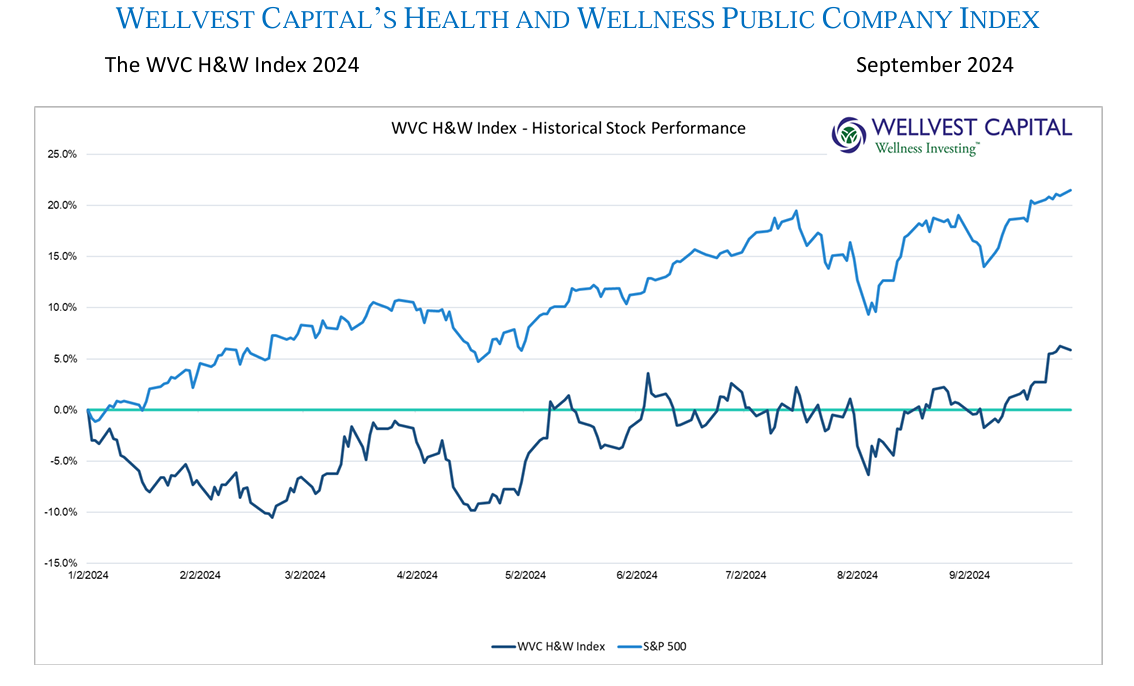

September has a long history of volatility for the stock market and this year did not disappoint. The headline driver was the 50bps drop in interest rates by the Fed on the 18th. Leading up to this the market became fixated on every ounce of economic news, creating sharp swings as market players positioned themselves for the cut-de-jour. Not to be left out of the party, the WVC H&W Index got swept up in this market action with a weak start and a strong finish ending with a 5.19% gain for the month and 5.85% YTD. The tech heavy S&P500 maintained its lead over the H&W Index with a 2.02% MTD return bring it to 20.85% YTD, excluding dividends.

Expect the fireworks that started in September to stay around for at least the next few months. Many of the big macro themes are bubbling to the top of investors focus. The presidential election in November will continue to fuel uncertainty, along with the escalating war in the Middle East and the protracted war in the Ukraine. And the newest threat, the Longshoremen’s strike which has the potential to once again disrupt supply chains, fuel inflation and pressure profits. Not to be overshadowed, the Fed’s monetary policy decisions and chatter will be a critical near-term driver. This macro mix, and company specific news will keep investors on their toes for the remainder of 2024.

What we do know is industries that are undergoing disruption from innovative upstarts battling with dominant entrenched legacy players witness incredible successes and monumental failures. Since the launch of Wellvest’s Health and Wellness Index nearly five years ago, this theme has played out in dramas both big and small. Bottom line: fundamental analysis and good-old-fashioned stock picking is needed for successful

investing in the health and wellness sector of the public markets.

THE LONG VIEW

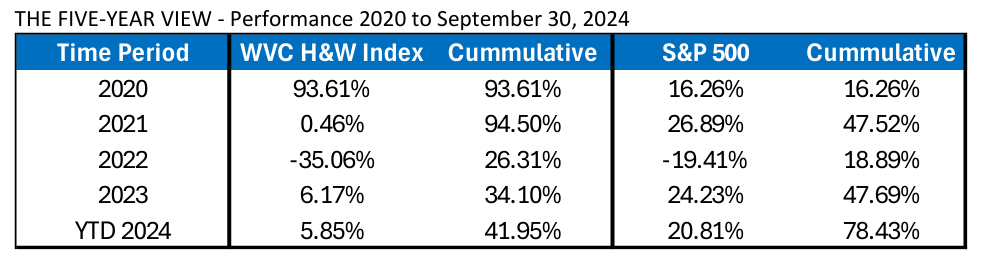

When Wellvest created our proprietary H&W Index public in late 2021, companies in the index were just starting to correct from flying high in 2020 and early 2021. During the period, from January 2020 to February 2021 the H&W Index was up about 140%, every day was Fat Tuesday! While it’s impossible to pinpoint the exact drivers of this extraordinary performance, the pandemic was certainly a major factor. The pandemic put a red-hot spotlight on the benefits of a healthy lifestyle which includes supplements and healthy foods and beverages. Couple this with the “reopening” tail winds of the period and the result is an extraordinary jump in the performance of the H&W sector. Unfortunately, none of this would last. By Q2 2021, the S&P500 was quickly closing the performance gap with the WVC H&W Index.

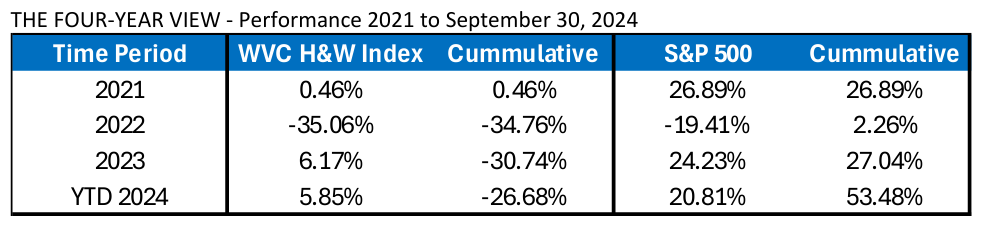

By the end of 2021 the WVC H&W Index was flat for the year with the S&P500 up 26.89%, excluding dividends. The performance gap from two years prior had been cut in half. This trend continued heading into 2022, which was a terrible year for the stock market in general. By year end 2022 the S&P500 was trailing the WVC H&W Index by only about 7%. From 2022 forward to today the S&P500 has handily beat the WVC H&W Index. By September 2024 month end the performance gap is nearly 37% on a cumulative basis since the start of 2020.

Excluding 2020 the WVC H&W Index has not fared well on an absolute basis and relative to the S&P500. From January 2021 to YTD 2024 the index is down 26.68% vs. the S&P500 up 53.48%, excluding dividends. The runaway train of a few years ago has been replaced by a massive shake out and write down of the sector. At the individual company level, the market is rewarding strong earnings and disregarding the speculative hype of the past.

THE BRIGHT SPOTS

Each update of the WVC H&W Index ends with our Winners and Losers list. A casual review clearly shows that the returns of individual stocks within the index varies wildly. Putting the anomaly of the pandemic aside; from the start of 2021 to today the cumulative return of a number of the index’s successful names has been outstanding. Sprouts Farmers Market (SFM) and Natural Grocers (NGVC) are leading the index with 445.77% and 111.02% return respectively. Proving that investing in “picks and shovels” during a gold rush can be the best path to outsized investment returns.

Another group of successful performers all benefit from building strong brands, delivering trusted value-add products and stable and profitable business models. Lifeway Foods (LWAY) has been executing for decades, it’s up 397.50% since 2021 despite significant family shareholder squabbles. On September 24th Lifeway received an unsolicited bid from Danone (PAR:BN) to acquire the approximately 76.6% of Lifeway it doesn’t already own, at $25 per share, a 59% premium to Lifeway’s $15.74 average price for the last three months. BellRing Brands (BRBR) is another long-time player, since being spun out of Post Holdings in Q1 2022 it has returned 147.84%. Cal-Maine Foods (CALM) with its egg business and flagship Land-o-Lakes egg brand has done well, generating 100.91% since 2021. Lastly, a true beverage innovator, Celsius Holdings (CELH) is up 89.91%.

Sadly, those on the Losers list have suffered from the sharp sword of GLP-1’s disruption, business models that where fundamentally flawed but greatly hyped, a lack of innovation and swiftly changing markets fueled by hip new brands. Through the third quarter of 2024 this list includes:

2021 – YTD 2024

|

Bowflex (n/a) |

-100.0% |

|

Beachbody (BODI) |

-98.9 |

|

WW (WW) |

-96.2 |

|

Oatly (OTLY) |

-95.6 |

|

Beyond Meat (BYND) |

-94.6 |

|

Zevia (ZVIA) |

-92.1 |

|

Medifast (MED) |

-90.1 |

|

Laird Superfood (LSF) |

-88.7 |

A NOD TO GRAHAM AND DODD

Ninety years ago, Graham and Dodd published their classic Security Analysis; when it comes to investing in the health and wellness sector, one would do themselves right by following the sage advice in this legendary text. In the health and wellness sector, rapid innovation, low barriers to entry, and consumer facing products create an investment environment where short term trends and the hype of novelty can overcome prudent decision making. For the very select few that are skilled enough to see these trends before the crowd the potential for excessive returns exist. For the 99.99% of the rest of the investing public, successful investing in the health and wellness section requires doing the homework and betting on companies that have the fundamentals that Graham and Dodd espoused nearly a hundred years ago.

Copyright: Wellvest Capital 2024