HIGHLIGHTS

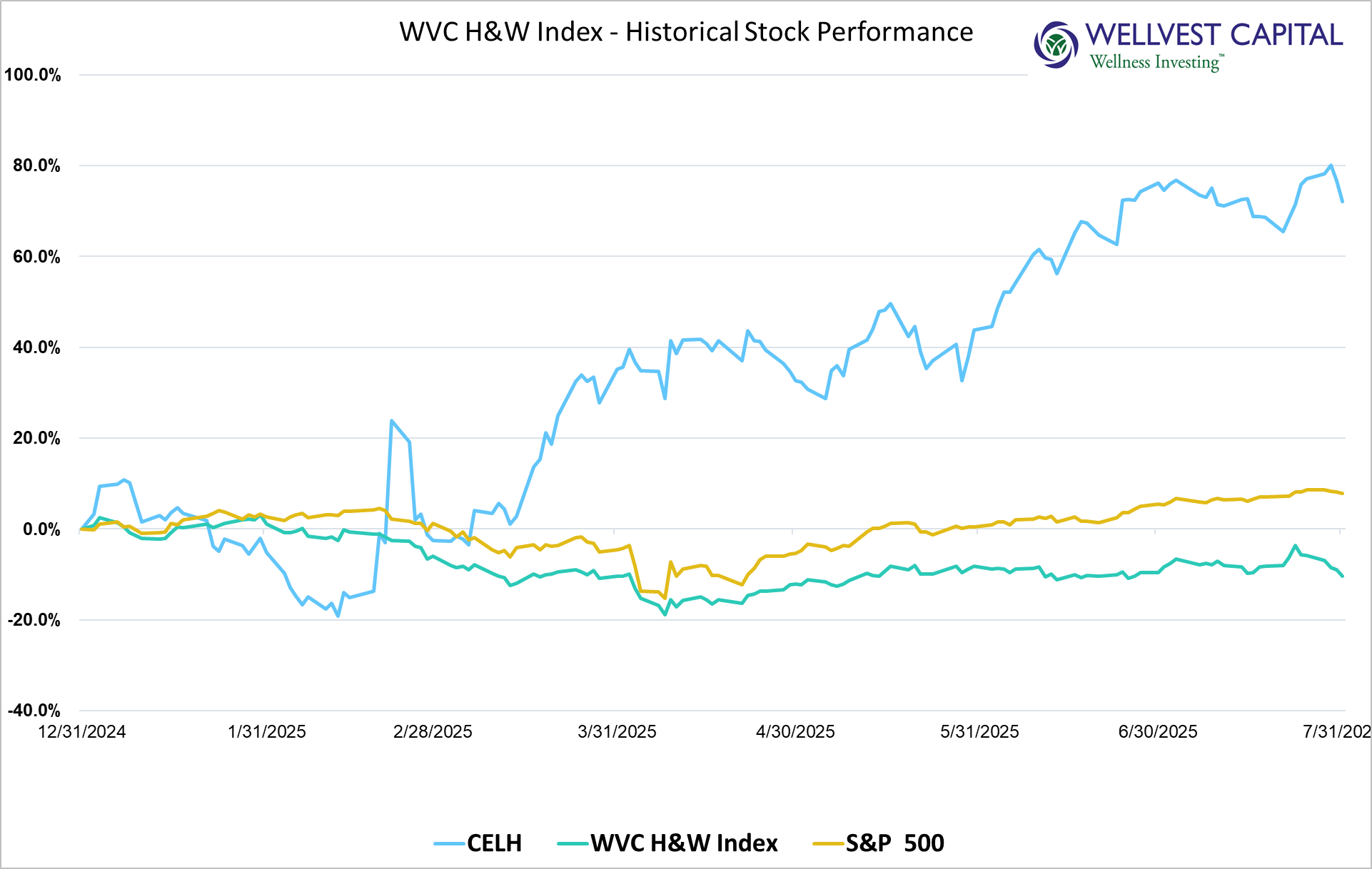

The not so faint rumbling of the proverbial “animal spirits” grew from a whisper to that of a lively party in the month of July. Meme stocks, short squeezes, crypto bulls and heavy buying of select tech names pushed the S&P500 to a 7.78% YTD gain up from 5.50% on May 31, excluding dividends. The Wellvest H&W Index did not reciprocate, shedding a few basis points, to end the month down 10.32% YTD, off <1% for the month of July. The health and wellness industry sells more goods than services resulting in tariffs having an outsized impact. Clearly this is weighing on the index.CONTRIBUTORS

The WVC H&W Index treaded water this month. Winners lagged losers by a count of 18 to 30. As the calendar flips to the later half of the year, our winners’ group is deteriorating, delivering 14.84% on average YTD versus 17.71% at the end of last month. Celsius Holdings (CELH) is juicing the index, with a gain of 72.1% for the year coming on strong earnings gains and accretive acquisitions. Herbalife Nutrition (HLF), Danone (PAR: BN), and Basi-Fit (BFIT) have generated above market returns of 37.5%, 21.2% and 20.7% respectively. The loser group slipped as well, collectively on average they have lost 25.43% of their value in 2025 through July 31, excluding dividends. This is a slight down-tick from May’s closing loss of 24.59%. No real meaningful new news for this cohort, just a shuffling of the deck chairs. Weight Watchers (WW) emerged from bankruptcy with an effective 93 to 1 reverse stock split for the equity holders, who are sitting on a 64.2% loss for the year. Helen of Troy (HELE) and The Hain Celestial Group (HAIN) are hogtied by deeply flawed business models; down 63.3% and 74.5% respectfully. Tariffs are not helping this group’s plight. Going into the rest of the year, clarity on tariffs, interest rates and macro economics could clear the clouds hanging over the health and wellness

sector.

H&W INDEX WINNERS and LOSERS – YTD as of July 31, 2025

- Top Five Winners

-

Celsius Holdings (CELH)72.1% -

Herbalife Nutrition (HLF)37.5

-

New Skin Enterprises (NUS)New Skin Enterprises (NUS)21.6

-

Danone (PAR: BN)21.2

-

Basic-Fit (BFIT)20.7

-

- Top Five Losers

-

Hain Celestial Group (HAIN)-74.5%

-

Weight Watchers (WGHTQ)-64.2

-

Helen of Troy (HELE)-63.3

-

Freshpet (FRPT)-53.9

-

Lululemon Athletica (LULU)-47.6

-

Copyright: Wellvest Capital 2025