January 31, 2022

WELLNESS MOMENTUM FADES

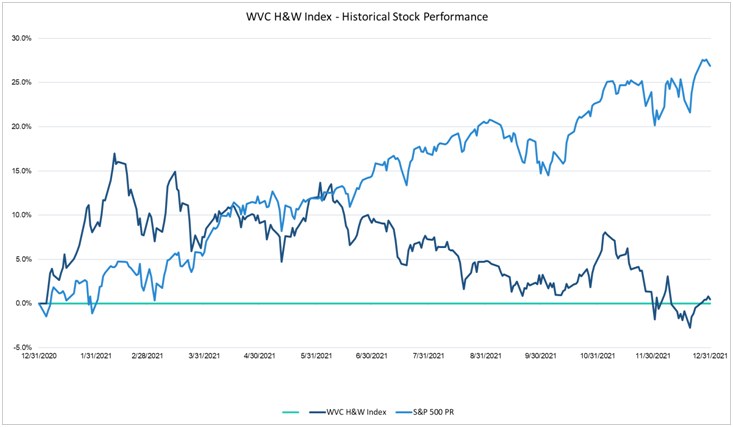

At the start of 2021, the COVID driven momentum in health and wellness pushed the WVC H&W Index to its calendar year peak gain of 17% in early February, besting the S&P500 by about 12% at the time. This outperformance was short lived as the index continued a downward slide through the rest of the year. By year end the WVC H&W Index eked out a 0.46% gain while the S&P500 returned 26.9% excluding dividends. Underlying the headline performance was an interesting market dynamic. Exactly half of the index’s constituents, 22 stocks, posted a positive return. This group averaged 28.4% modestly beating the S&P 500. Offsetting this was the bottom cohort which lost on average 36.2%*. The timing of IPOs and M&A rounded out the net gain to 0.46% for the index in 2021.

While the top half of the WVC H&W Index did better than hold its own versus the S&P, a handful of sub-sectors benefited from broader consumer trends in health and wellness with food, consumer goods and CPG brands performing well. Distributor and grocer United Natural Foods was the index’s strongest performer with over a 200% pop for the year, followed by Sprouts Farmers Market with 47.7%. Consumer goods and CPG businesses generally kept pace with the benchmark with a skew towards relative weakness. Food brand Simply Good Foods outperformed with a 32.6% return, followed by peers Nestle and Bell Ring Brands both dishing out mid-teens returns. Giant Bikes made a positive contribution by keeping pace with the benchmark S&P 500. One can only speculate what could have been if these companies did not have the enormous headwinds of supply chain shocks, wage inflation and staffing shortages. The smart money would bet on an even more impressive performance from these sub-sectors.

Back in 2020 the “COVID Quarantine” trade priced in enormous premiums into stocks that benefited from the stay-at-home disruption, only to be crushed in early 2021 as vaccinations came on-line and the “reopening” trade took control. This market pivot impacted companies in the WVC H&W Index including Peloton, Nautilus, and Laird Superfoods, which lost 76.4%, 66.2% and 72.4% respectively in 2021. Plant based bellwether Beyond Meat, lost its sizzle, rounding out this disastrous group with a 47.9% loss on the year. Looking forward this group and others similarly situated will continue to experience an outsized impact from the ebbs and flows of the pandemic as well as the need to prove to investors the profitability and lasting power of their business models.

The red-hot IPO market in 2021 included several health and wellness companies that caught investors’ attention at the outset only to suffer punishing losses as lofty expectations were met with a dose of reality during earning season. Oatly, The Honest Company, Zevia, and Thorne Health Tech were new additions to the WVC H&W Index during the year. Collectively these companies experienced price decreases of 38% to 53% from their IPO price, pulling down the relatively concentrated index. The consumer demand that these companies fill by providing healthier products, socially minded management and sustainable solutions remains strong and expanding. To reignite investors’ enthusiasm will require consistently meeting expectations and delivering results quarter after quarter.

THOUGHTS FOR 2022

The BIG themes – the pandemic, inflation, labor shortages and supply chain disruptions are unlikely to magically disappear over the next twelve months, with some luck they may diminish in magnitude. The companies in WVC H&W Index will need to continue to navigate these challenges as well as leverage the benefits of the now entrenched consumer focus on health and wellness. Under the surface, in the private markets, capital investment continues to pour into health and wellness companies with nearly $17B from VC investment in “health-tech” alone for the twelve months ending September 2021. The implications in 2022 for public companies in the sector is increased competitions from well-funded, fast moving, and innovative new market players. In 2021 the plant-base/alt meat sector was a notable example, in 2022 look for snacking, consumer healthcare, sexual wellness and beverage incumbents to be under pressure from these agile disruptors.

The WVC H&W Index contains many more small cap names then large caps which could be a tail wind for the index in 2022 relative to the large cap S&P 500 index. As most readers may already know, small caps returns have lagged large caps over several years and to a noticeable degree. Small caps as represented by the Russell 2000 have returned 23.7%, 18.4%, 14.8% in 2019, 2020 and 2021 respectfully. Compared to S&P 500 returns of 31.5%, 18.4%, and 26.9% over the same time period. It’s always challenging to forecast the timing of major market rotations, however if small caps do come back into favor in 2022 this could provide wellness investors a performance kicker and a constructive macro environment.

Coil the Spring – be prepared

A few months back we said “This is just the beginning. Health and wellness in all its forms; preventative care, telemedicine, better-for-you foods, functional beverages, integrative medicine, and fitness are here to stay.” This statement is even more true today than it was back then. From a public market perspective, the health and wellness investment thesis is just getting off the ground floor. Wellvest believes monitoring the public markets through Wellvest’s Health and Wellness Index will inform private market transactions be they VC, PE or M&A. Public market valuations, trends and dynamics have long provided a key back drop to private markets. Now we are in the beneficial position of having public benchmarks and comps that directly correlate to our growing, essential, and influential industry. We will keep you posted!