HIGHLIGHTS

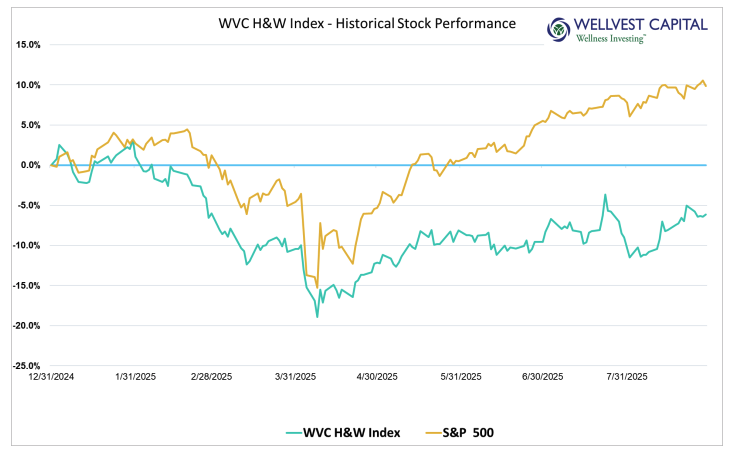

The bellwether index had a quiet month of just slowly grinding upward. The old saw “never short a dull market” seemed to have some legs this month with the S&P500 up 1.91% for the month, bringing the YTD gain to 9.84%, excluding dividends. Like a fine summer day at the beach, a few thunder clouds were on the horizon but never materialized. The Wellvest H&W Index was in catch up mode, up 4.65% for the month, settling down 6.15% YTD, excluding dividends. Perhaps investors have come to realize that tariffs may not be the end of the world for the health and wellness sector, or they were enjoying the beach too much to sell.

Macro themes and AI continue to overshadow just about everything except Nvidia’s earnings. Say what you will about this atmosphere it leaves little mind share available for the fundamental longterm trends. driving the health and wellness industry. The general uncertainty regarding tariffs, interest rates and inflation may have created advantageous buying opportunities in the health and wellness sector for long term investors willing to hunt for them

CONTRIBUTORS

The WVC H&W Index did relatively well this month compared to the S&P500. Under the calm surface there were a few monumental gainers and epic failures during the month. Let’s dive in! Microcap, Grow Generation (GRWG) grew 72.6% during the month to rise up to about even for the year. Vital Farms (VITL) had a 37.4% pop, plowing ahead with a 35.6% gain YTD 2025. Nu Skin (NUS) was part of this winner’s group, adding 45.2% for the month on top of a great year; YTD it’s up 76.6%. And finally, there is no shortage of energy at Celsius Holdings, a big 38.7% gain for the month, topping up the YTD total to 138.7%; the biggest winner in the index. The failures were mostly the same cast of characters. WW (WGHTQ) (formerly Weight Watchers) came out of bankruptcy to lose another 24.63% on top of a dismal year, losing 73% YTD. Declining revenue, missed earnings, weak demand and tariffs conspired

to pull down Under Armour (UAA) by 24.7% in August; the stock is off nearly 40% for the year. A weak earnings report and under performance of it’s protein RTD brand, dropped Bell Ring Brands by 24.8% for the month and 45.5% for the year. As we move toward Q4, it’s crunch time for the health and wellness sector, stay tuned.

H&W INDEX WINNERS and LOSERS – YTD as of Augst 29, 2025

- Top Five Winners

|

|

|

|

|

|

|

|

|

|

- Top Five Losers

|

|

|

|

|

|

|

|

|

|

Data sources: Pitchbook

Copyright: Wellvest Capital 2025