A.I. AND MACRO STORY DOMINATE

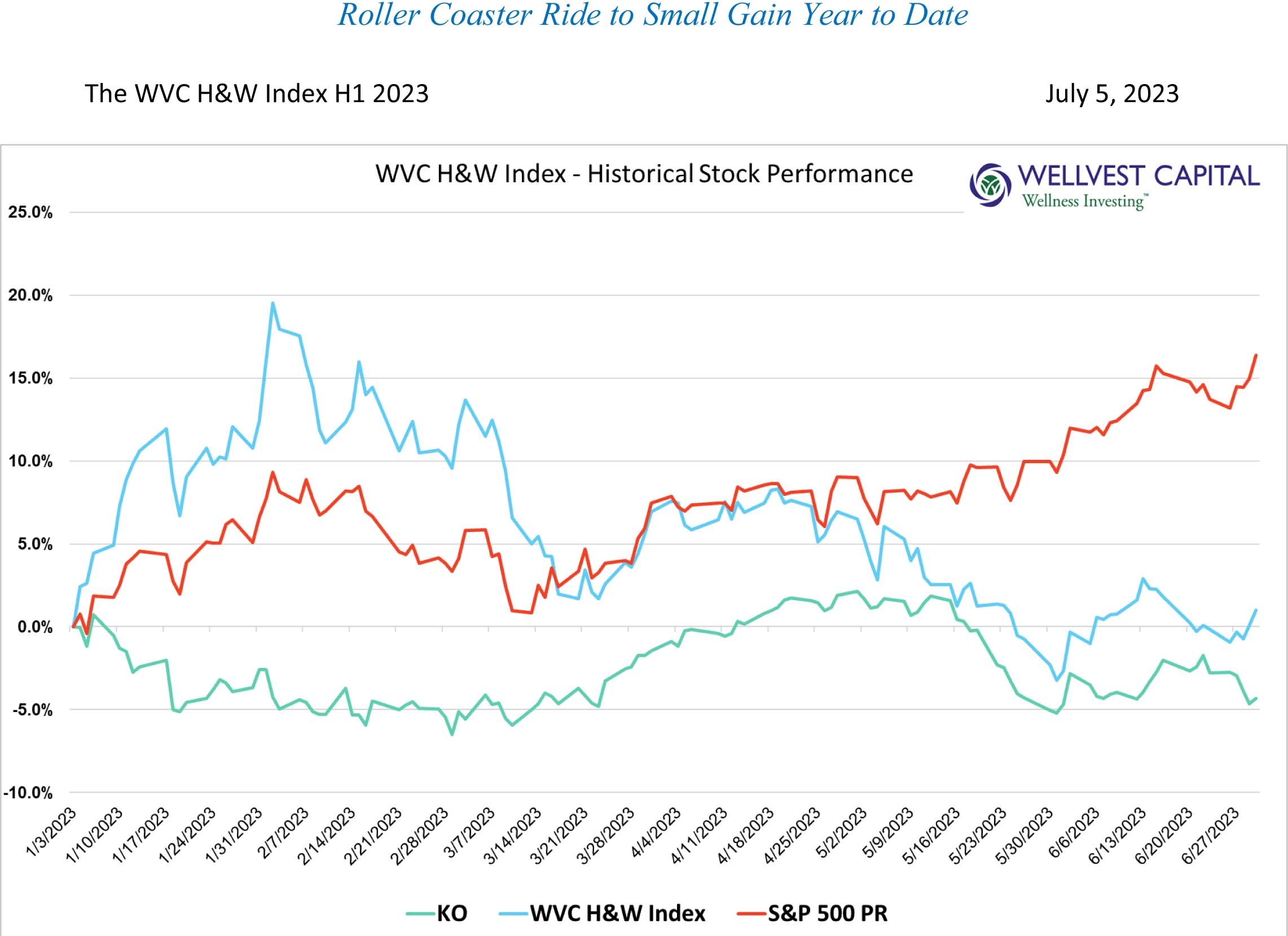

What began as a promising start for the Wellvest Health and Wellness Public Company Index (“WVC H&W Index”) quickly faded as the calendar turned to late Spring with the index retreating from a 19.5% high in early February to a 1.0% return through June 30th, excluding dividends. Compared to the S&P 500 and NADAQ , the WVC H&W Index was no match for the “A.I.” driven rally in these major indexes. Interestingly, from a valuation perspective the WVC H&W Index has held its own with a forward PE of 21.7 which is slightly ahead of the S&P500 forward PE of 19.4. Indicating that the strong consumer value proposition and pricing power of the health and wellness industry is being recognized by investors.

The macro narrative has dominated the markets this year. Interest rates and inflation are leading the conversation with a host of secondary themes adding to the story. The Ukraine war, China tensions, the debt ceiling standoff and the pandemic hangover of labor and supply chain issues are all being discounted into market prices. The strong 16.38% gain by the S&P500 during this period was sparked by a handful of A.I. and technology stocks up until just recently. Interestingly the market rally appears to have started to broaden out as indicated by the Russell 2000 rally of 3.16% and S&500 Equal Weighting 4.44%, in the month of June as compared to the S&P500 return of 3.92%. Earlier in the year the broader market significantly lagged the S&P 500. The noise of the macro backdrop and the mind-bending potential of A.I. made it challenging for the WVC H&W Index to gain traction with investors. While the Index was up slightly for the period many of the individual stocks did exceptionally well.

The top 10 performers returned 40.7% as a group, besting the red-hot NASDQ’s return of 32.74%. This leadership group was led by WW International (WW) up 74.1% tied to a deal to sell wonder drug Ozempic. European fitness club operator, Basic Fit (BFIT) outperformed with a 45.9% return, just edging out Bell Ring Brands (BRBR) 42.7 gain. Four out of the top ten stocks in the WVC H&W Index are in the nutritional supplement category which has risen to prominence during the pandemic and continues to attract investors’ attention both in the public markets and private M&A markets. Natural Health Trends (NHTC), Thorne Research (THRN), Else Nutrition Holdings (BABY) and USANA Health Sciences (USNA) had a strong showing, returning 61.2%, 29.2%, 26.5% and 18.5% respectively.

The first half of 2023 was not kind to the bottom bracket of the WVC H&W Index, with the bottom ten companies losing 28.8%. United Natural Foods led the way down with a 49.5% loss due to poor earnings. The Honest Company and Blue Apron continued to struggle with 43.9% and 41.4% losses as investors continued to question their business models. Under Armour and Hain Celestial Group rounded out the bottom with losses of 28.9% and 22.7% respectively.

SHIFTING INDUSTRY DYNAMICS

The very long-term trends that created the health and wellness sector continue to exert their influence. One June 29th Reuters reported that the artificial sweetener “Aspartame” was soon to be declared a cancer-causing agent by the World Health Organization. Aspartame is widely used in food and beverages including Diet Coke, one of the bestselling soft drinks globally. Coke-Cola (KO -4.34% YTD) stock sold off on the news along with Keurig Diet Pepper (KDP -12.04% YTD). Many of the companies in the WVC H&W Index have a stated mission to deliver better-for-you products. This often includes the avoidance of artificial ingredients. The long-term impact to Diet Coke will play out over time, but this pronouncement will be sure to raise consumer awareness on the perceived dangers of artificial ingredients.

Another significant event occurred in November 2022 when the FDA declared “cultivated” meat to be safe for consumers starting with chicken made by Upside Foods, a private VC backed company. In June 2023 the USDA approved the product for sale in the United States. This is a watershed moment for this emerging corner of the alternative protein category. These disruptive products; chicken, beef and seafood are all made by VC backed companies at various stages of development. One the surface they appear to be at odd with the plant-based movement, but they share the same sustainability missions. While consumers may need to be educated about these innovative products the sustainability message will be loud and clear. No public companies are pure plays in this space, but we expect some will come to market in the next 6-18 months as awareness rises as products land on the shelf.

The green shoots in the IPO market could be setting the stage for a resurgence in health and wellness IPOs in 2024 and beyond. IPO volume in 2023 has picked up with 77 deals coming to market. Keep an eye on the cultivated meat space. Companies like Upside Foods, Super Meat, Mosa Meat, Blue Nalu, Wild Earth, Aleph Farms and Believer could be candidates for public listing in the near to medium term. In addition to alt-proteins, better-for-you snacking, and cleanbeauty could be looking for liquidity and capital via IPOs as well.

Coil the Spring – be prepared

Seasoned investors know that the stock market can be more irrational and fixated than your average toddler. In the very near term the current buzz; A.I., interest rates, and geo-political risks will overshadow the accelerating fundamental shifts driving the health and wellness sector. But the steady drum beat of consumers and society demanding solutions to climate change, chronic health conditions, and sustainability goes on. The health and wellness industry from food, beverages, apparel, fitness, and mental health services are designed to meet these challenges head on. Business models will change over time and winners and losers will come and go, but in the long term the sector will continue to thrive. The next IPO cycle will be fascinating to see what categories and companies emerge. As always, we will keep you posted.

About WELLVEST CAPITAL’S HEALTH AND WELLNESS PUBLIC COMPANY INDEX

To capture the new health and wellness investment dynamic, Wellvest Capital created our proprietary “Health and Wellness Index” (WVC H&W Index). This index is comprised of approximately 50 US publicly listed companies of all capitalizations that are active participants in the health and wellness industry providing a wide range of goods and services. Being a rapidly evolving sector with many emerging small-capitalized businesses competing with legacy large cap companies, the index utilizes an equal weighted calculation methodology. Better-for-you food and beverages, vitamins & supplements, fitness apparel and equipment, ingredient suppliers and weight loss are characteristic of the categories included. Beyond Meat, Lululemon, Oatly, SunOpta, Nestle, The Honest Company, Sprouts Farmers Market, and Peloton are representative of the group.

Please visit Wellvest’s library of insights and articles at wellvestcapital.com/newsroom