UPSIDE SURPRISE FOR THE S&P 500

Coming into 2024, few would have predicted a 14.48% return, excluding dividends, for the S&P 500 in the first half of the year. A handful of bullish factors combined to overrun the bears resulting in outstanding performance. The lead story was Artificial Intelligence (AI) whose potential impact has been compared to the invention of electricity. Not to be upstaged, Chairman Powell keep things lively with both dovish and hawkish commentary. While this created a fair amount of short-term volatility, it most likely was a net positive to the markets with overall sentiment positive with regards to a rate cut later in the year. Coupled with the Chairman’s views on rates was the markets’ read on economic indicators and inflation. These data points sprinkled throughout the calendar provided the S&P 500 the excuse to continue its upward march for the period. Lastly, strong earnings reports, particularly in technology, bolstered investors’ confidence and stirred some animal spirits and risk taking. Offsetting these bullish factors was the usual suspects of wars, geopolitical tensions, inflation, and banking sector concerns. While impactful on a sector basis, these were not enough to derail the bull market in the first half of 2024.

WVC H&W INDEX MAKES MODEST COMEBACK

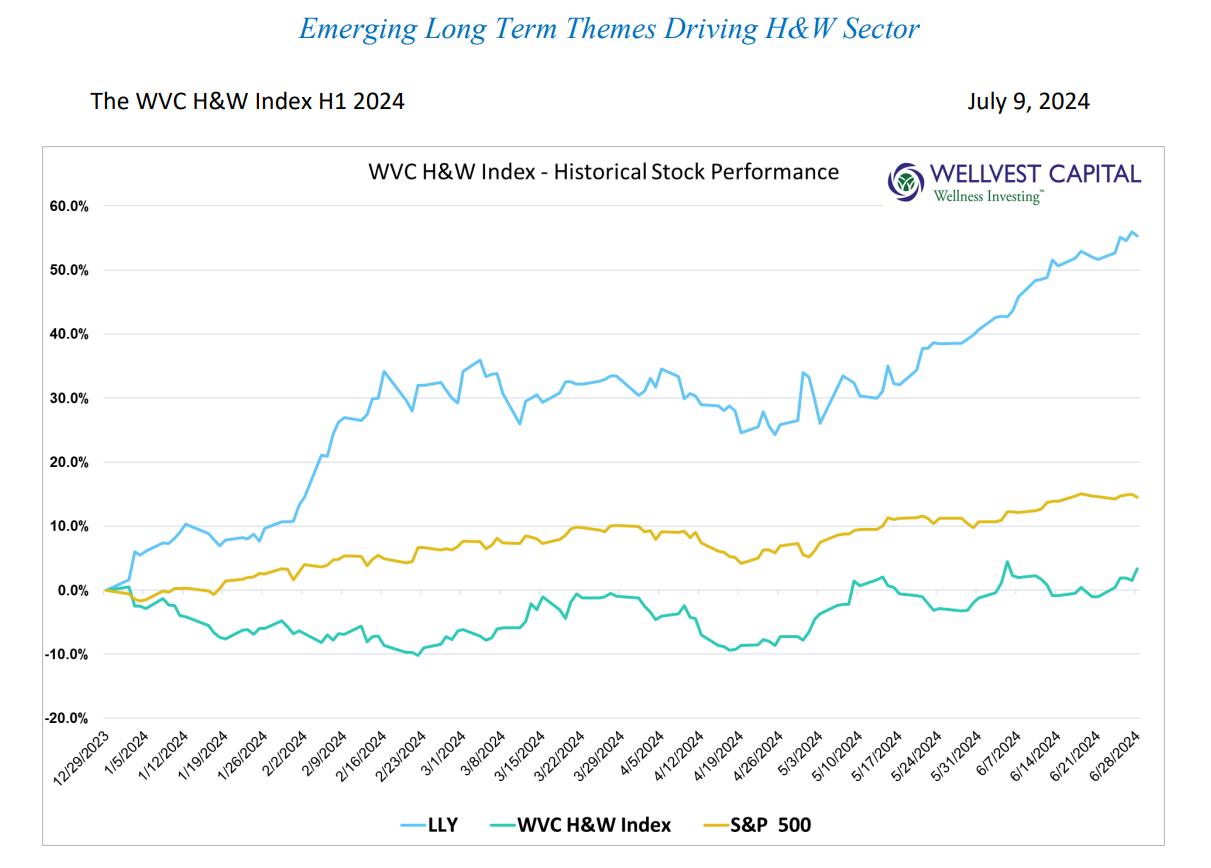

The WVC H&W Index delivered a modest return in the first half of the year, generating a 3.38% gain, excluding dividends. While still below the blistering pace of the S&P 500 by 11.1% it was a marked improvement over the dismal performance of past years. More interesting than the headline news are the details of the individual stocks in the index. The upside gain was attributed to the top 5 winners which as a group increase by 174.2% in the first half. This included a huge jump of 517.6% by Laird Superfood (LSF) due to solid earnings reports and cost cutting. Following close behind was Vital Farms (VITL) with a 198.1% pop on a top line revenue beat and increased projections. Rounding out the winners were grocers Sprouts Farmers Market (SFM), Natural Grocers (NGVC), and Freshpet (FRPT) with 73.9%, 32.5% and 49.1% gains respectively. Offsetting these spectacular results was the bottom tier of losers, which collectively lost 73.0% over the first half of the year. Unfortunately for these companies, the market has run out of patience. Bowflex (BFX) declared Chapter 11 bankruptcy in March and was sold in April, equity holders were wiped out. WW International (WW), a former Wall Street darling was crushed by the anvil of the GLP-1 trend, losing 86.6% YTD, through June 30. Medifast (MED) was in this same camp, down 67.5%. Zevia (ZVIA) continues to struggle, losing 66.2% and lastly Nu Skin Enterprises (NUS) lost 45.7% for the period. For the companies in the WVC H&W Index, the market has clearly spoken, strong earnings and growth are being rewarded with expanded multiples with failures being decimated.

EMERGING LONG-TERM TRENDS DRIVING CHANGE

In January 2024 Wellvest Capital called attention to the impact GLP-1 drugs (i.e., Ozempic®, Wegovy®) would have on the H&W sector, stating:

If these drugs do become the elusive “silver bullet” that so many are claiming, the implications are far reaching, and will heavily influence healthcare, pharma, food/beverage, supplements, fitness, and even fashion. Heading deeper into 2024 keep an eye on this rapidly evolving situation.

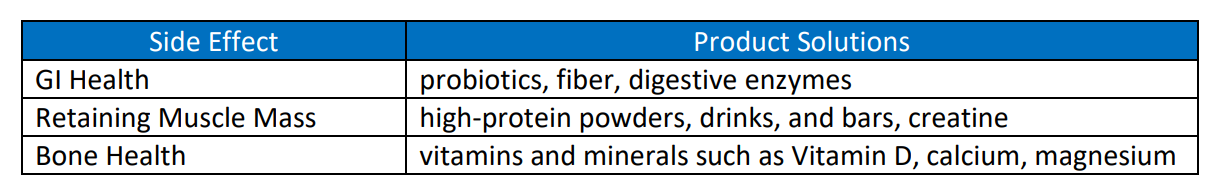

This impact has continued to play out in the first half of 2024. Eli Lilly (LLY) value increased 55.32% resulting in a sky-high PE over 130! FDA approvals of its GLP-1 drugs, announcement of “LillyDirect”, and earnings beats has combined to drive to stock to new highs. The Health & Wellness sector is also benefiting from the GLP-1 excitement. The side effects of these medications are the genesis of a new sub-category. Supplement brands and retailers are aggressively rolling out “GLP-1 support products” to address the side effects. Leading supplement retailers are marketing directly to GLP-1 users via various product bundling and consumer education initiatives. Product offerings include:

Companies like GNC, The Vitamin Shoppe, Nestlé (SWX:NESN) down 11.7% YTD, Herbalife (HLF) down 31.9%% YTD, Daily Harvest, Nutrisystem, and potentially Walmart (WMT) up 27.5% YTD are at the forefront of this change, offering innovative products and support systems to address the unique needs of GLP-1 users. As the number of patients on these medications grows, the demand for specialized nutritional support will continue to rise, driving further innovation and development in these markets.

Coil the Spring – be prepared

The first half of 2024 saw the S&P 500 defy expectations with a 14.48% return, driven by the promise of AI, strategic signals from Chairman Powell, positive economic indicators, and robust earnings in the tech sector. Despite challenges like geopolitical tensions, inflation, and banking sector issues, the market’s momentum remained strong. The H&W sector also showed resilience, with the WVC H&W Index posting a respectable gain, though lagging behind the S&P 500. Looking forward, we believe the impact of GLP-1 drugs will continue to be felt across the H&W sector. The emerging sub-category of supplementary products addressing side effects will continue to evolve with consumer adoption and awareness increasing over time. We suspect the balance of 2024 to be largely driven by macro factors; the presidential race, interest rates and geopolitical risks. Behind the scenes markets participants in the H&W sector are wise to stay tuned to the evolving GLP-1 story and opportunities, sector inflation, and the evolving priorities and preferences of Gen Z and Millennials.

About WELLVEST CAPITAL’S HEALTH AND WELLNESS PUBLIC COMPANY INDEX

To capture the new health and wellness investment dynamic, Wellvest Capital created our proprietary “Health and Wellness Index” (WVC H&W Index). This index is comprised of approximately 50 US publicly listed companies of all capitalizations that are active participants in the health and wellness industry providing a wide range of goods and services. Being a rapidly evolving sector with many emerging small-capitalized businesses competing with legacy large cap companies, the index utilizes an equal weighted calculation methodology. Better-for-you food and beverages, vitamins & supplements, fitness apparel and equipment, ingredient suppliers and weight loss are characteristic of the categories included. Beyond Meat, Lululemon, Oatly, SunOpta, Nestle, The Honest Company, Sprouts Farmers Market, and Peloton are representative of the group.

Please visit Wellvest’s library of insights and articles at wellvestcapital.com/newsroom

Data sources: Pitchbook, Standard and Poor’s

Copyright: Wellvest Capital 2024