Roller Coaster Ride Continued in Second Half

INTEREST RATE OUTLOOK LIFTS ALL SHIPS

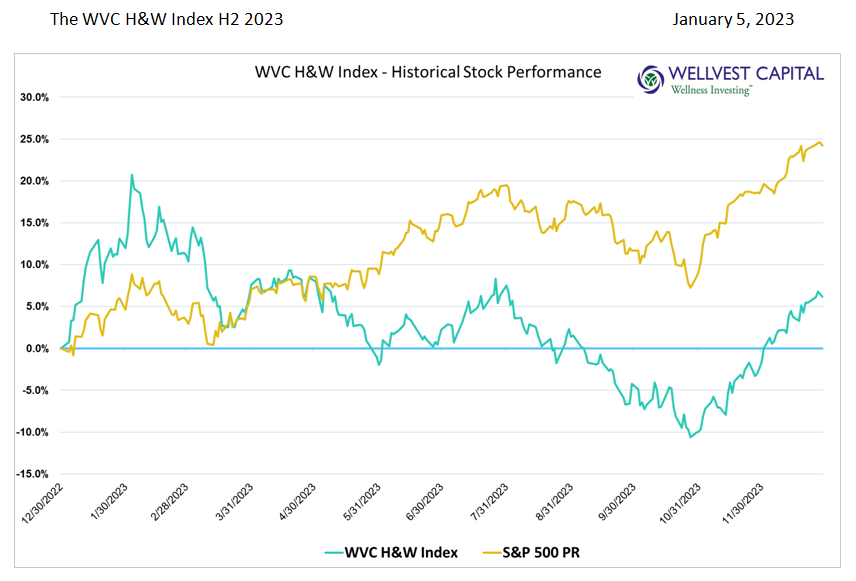

The Wellvest Health and Wellness Public Company Index (“WVC H&W Index”) was heavily influenced by the interest rate outlook. By year end the index experienced a modest uptick from mid-year generating a positive annual return of 6.17%, excluding dividends. Any gain is a good gain but it was nothing compared to the red-hot S&P 500 and NASDAQ which the WVC H&W Index lagging far behind compared to their 24.23% and 42.13% annual return respectively, excluding dividends.

The macro narrative that dominated the markets the first half of the year continued to overwhelm nearly everything else in Q3 and Q4. Interest rate expectations were a tsunami washing over the market. Belief in multiple Fed Funds rate cuts in 2024 created an explosion in upside momentum late in the year. The negative geopolitical backdrop had virtually no impact even with a new war in the middle east, dragging Ukraine conflict, unabated China tensions and US political gridlock. Interestingly the broadening market participation that started mid-year gained more traction as the year came to a close. The Russell 2000 rally in Q4 of 14.0% resulted in an annual return of 16.93%. Given the performance concentration of the “Magnificent Seven” we suspect that a fair amount of this late year rally in small caps and out-of-favor names was an attempt by professionals and individual investors to close the performance gap.

As witnessed over the last few years, the WVC H&W Index overall performance has not told the real sector story; this requires getting under the hood. The top 10 performers returned 92.3% as a group, crushing all competitors. This leadership group was led by buy-out target Thorne Research (THRN) up 180.7%, Lifeway Foods (LWAY) delivering a 141.6% gain, WW International (WW) up 126.7% tied to a deal to sell wonder drug Ozempic, and spin-off BellRing Brands (BRBR) up 116.2%. Offsetting this great group was the bottom bracket of the WVC H&W Index, with the bottom ten companies losing 54.9%. As previously reported by Wellvest, this lagging group was a motley assortment of weak business models, valuation right-sizing and flat-out desperate management decisions. Leading this infamous set was Smart for Life (SMFL) down 95.3% due to multiple reverse stock splits, followed by RiceBran Technologies (RIBT) off 68.6%, Else Nutrition Holdings (BABY) which started out strong early only to fade fast, ending up down 59.5% for the year. Rounding it out was Nu Skin Enterprises (NUS), down 53.9%.

THE BEGINNING OF THE END OF THE SHAKEOUT

The anticipation of interest rate cuts is rational given that inflation, as measured by the CPI, has dropped from 9.1 in June 2022 to 3.2 in October 2023; even if the late 2023 market move may have been irrational. This tempering of inflation provides a constructive backdrop for companies to reset growth expectation based on volume and not just price increases. Many of the constituents in the WVC H&W Index are food and beverages related brands, distributors, and retailers; thus, inflation and consumers’ sensitivity to price has an outsized impact on their financial performance, as reflected in the Index. As highlighted earlier, the market in 2023 rewarded strong operators and severely punished unprofitable companies and questionable business models. This “culling of the herd” has been even more dramatic in the private markets where VC and PE have significantly reduced funding and debt is costly and hard to come by; fueling a bull market in bankruptcies.

With the investment excesses of past years, supply/demand imbalances and inflation appearing to be behind us, we expect 2024 to be an inflection point for the health and wellness industry. A more stable business operating environment should translate into improved financial performance and higher valuations. The dynamics that are the foundation of the health and wellness investment thesis have continued unabated as consumers seek products and services that support healthy lifestyles. Emerging trends in sustainable and regenerative agriculture, weight management, “cultivated” chicken, beef and seafood, and functional foods are a few of the intriguing categories that investors should monitor in 2024 and beyond.

Coil the Spring – be prepared

In 2023, the WVC H&W Index experienced a modest 6.17% increase, underperforming against broader indices like the S&P 500 and NASDAQ due to dominating interest rate expectations and macroeconomic factors. The market’s anticipation of Federal Reserve rate cuts buoyed certain sectors while overshadowing geopolitical tensions. The health and wellness sector saw significant disparities within its ranks, with the top and bottom performers in the Index showing stark differences in returns. Looking ahead to 2024, with easing inflation and a more stable operating environment, we hold an optimistic outlook for the health and wellness industry, especially as emerging trends like sustainable agriculture, supplement innovations, and functional foods gain traction among consumers seeking healthier lifestyles.

About WELLVEST CAPITAL’S HEALTH AND WELLNESS PUBLIC COMPANY INDEX

To capture the new health and wellness investment dynamic, Wellvest Capital created our proprietary “Health and Wellness Index” (WVC H&W Index). This index is comprised of approximately 50 US publicly listed companies of all capitalizations that are active participants in the health and wellness industry providing a wide range of goods and services. Being a rapidly evolving sector with many emerging small-capitalized businesses competing with legacy large cap companies, the index utilizes an equal weighted calculation methodology. Better-for-you food and beverages, vitamins & supplements, fitness apparel and equipment, ingredient suppliers and weight loss are characteristic of the categories included. Beyond Meat, Lululemon, Oatly, SunOpta, Nestle, The Honest Company, Sprouts Farmers Market, and Peloton are representative of the group.

Please visit Wellvest’s library of insights and articles at wellvestcapital.com/newsroom

Data sources: Pitchbook, Market Watch, Ycharts, US Bureau of Labor Statistics. Copyright: Wellvest Capital 2023