ENDLESS GRIND UPWARD

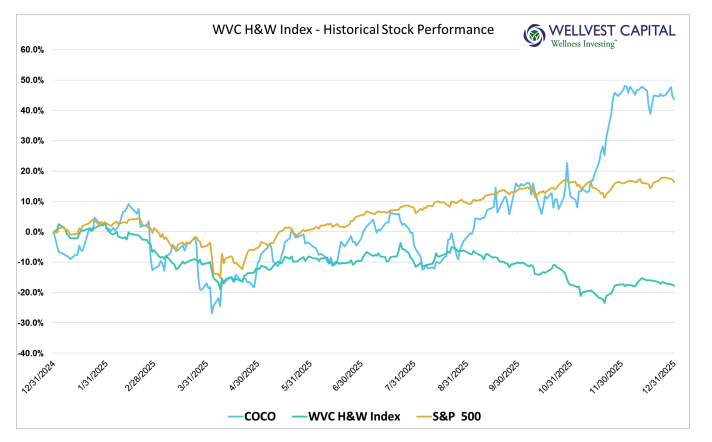

The equity markets’ performance over the second half of 2025 had a remarkable disconnect from the perceived reality of market pundits which cried wolf of an eminent crash around every corner. For the year 2025 the S&P500 index was up 16.39% (excluding dividends) which is a very respectable return but not overly impressive compared to past big up-years. Most of these returns were made in the second half of the year. As of June 30, the S&P500 had gained 5.50% by year end it had tacked on another 11%+. As the yellow line above shows, this increase was notoriously steady, with very few significant draw downs. One would think the macro environment was just as calm. Not the case. Risk assets climbed the “wall of worry” surrounded by heighted risks of all shapes and sizes, both real and perceived. Talk of AI bubbles, Federal Reserve independence, interest rate cuts, protracted wars, new global military actions, China dominance, constitutional crises, and ever-present inflation dominated the mind share of individual and institutional investors alike.

The Wellvest Health and Wellness Index was unfortunately the polar opposite of the S&P500 over the second half of 2025. As of June 30, the index was down 9.56% (excluding dividends) only to close out the year down 17.76%. Ouch! In all fairness, this is not an apples-to-apples comparison. Due to the many micro-cap and small cap names in the WVC H&W Index, it is calculated on an equal weighted basis versus the market cap weighting of the S&P500. On a market weighted cap basis the WVC H&W Index gained 7.53% as compared to the S&P500 Equal Weight return of 9.34%. Much like the major index, the large cap companies in the health and wellness sector greatly outperformed. For example, Nestle’ is by far the largest market cap company in the index; with a 2025 gain of 20.2% it had a significant impact on the market weighted calculation.

MORE OF THE SAME

At mid-year, we reported that the halo effect of the MAHA platform that was sparked in late 2024 and early 2025 had begun to fade. This continued into the latter half of the year with market participants focused on the AI trade to the detriment of just about everything else, reminiscent of the .com era. At the very tail end of the year, the health and wellness sector started to recover and participate in the broadening of the bull rally. The market rewarded a handful of health and wellness companies with strong performance over the second half of the year. Beachbody (BODI) was up 151.5% over the period. Investors clearly liked the business model shift from Multi-Level Marketer (MLM) to a Single-Level Affiliate Program; Herbalife Nutrition (HLF) kept pace with a 49.5% pop bringing the annual gain to 92.7%. Nu Skin Enterprises (NUS) did the same, adding 20.4% in the back half of the year to advance 39.6% for 2025. Both Herbalife and Nu Skin are in the midst of evolving their business models from purely MLM to Direct Digital Engagement models. If these changes drive better top and bottom-line performance, we expect investors to continue to reward them. While those investors clairvoyant enough to pick these winners did well, the rest of the pack continued to suffer significant losses.

The train wreck of losers is an infamous cast of characters, many of which we have highlighted in our monthly updates. Beyond Meat (BYND) is the leader of this pack, down 78.2% for the year with most of this drop happening since June. And let’s not forget the meme-stock wild ride this stock had back in October. The Hain Celestial Group’s (HAIN) tried to right the ship by firing the CEO, but no luck yet; the stock lost another 30.1% in the second half bringing the annual loss to 82.6%. A similar story was found at Helen of Troy (HELE), the CEO is out and the stock is off 64.5% for the year. A few other notable laggards: since June 30th Laird Superfood (LSF) slumped 64.7%, Bell Ring Brands (BRBR) was down 53.8% and The Honest Company (HNST) shed 49.4%. Until these companies can correct their broken business models and deliver consistent profits, they are doomed to be bled out by investors that have grown tired of empty promises

REWARDS FOR WELL RUN INNOVATION

Over the long term the markets, both public and private, have a tendency to bid up the valuations of well-run innovative companies in the health and wellness sector. While many of them remain private until sold to strategics, their success underpins the publics markets. Brands like Vitamin Water and Cliff Bar are case studies in what is possible in the sector. Both of which reached scale and sold for high multiples to strategic buyers. On the public side, The WVC H&W Index had a handful of standout performers in 2025. This group included Vita Coco Company (COCO). The company is an innovator in functional beverages, turning little known coconut water into a mainstream product. The stock was up 43.6% for the year, raising the market cap to over $3 Billion. Celsius Holdings (CELH) had a great year, up 73.7% on earnings beats and an accretive acquisition. Herbalife Nutrition (HLF) jumped 49.5% in the second half of the year and nearly doubled in value in 2025 driven by great earnings and analyst upgrades

Coil the Spring – be prepared

As the page is turned on 2025, health and wellness remains top of mind for multiple generations of consumers. This long-term trend is now entrenched, supporting the investment thesis in the category. Investors can ride this lasting shift in consumers’ behavior which is impacting purchasing decisions across a wide range of goods and services. What struck us most in 2025 was the wholesale market rejection of poor business models and the embracing, even if a bit begrudgingly, of companies with excellent leadership teams, strong gross margins, nimble operations, and an authentic dedication to health and wellness

About WELLVEST CAPITAL’S HEALTH AND WELLNESS PUBLIC COMPANY INDEX

In 2021 with the intention of capturing the new health and wellness investment dynamic, Wellvest Capital created our proprietary “Health and Wellness Index” (WVC H&W Index). This index is comprised of approximately 50 US publicly listed companies of all capitalizations that are active participants in the health and wellness industry providing a wide range of goods and services. Being a rapidly evolving sector with many emerging small-capitalized businesses competing with legacy large cap companies, the index utilizes an equal weighted calculation methodology. Better-for-you food and beverages, vitamins & supplements, fitness apparel and equipment, ingredient suppliers and weight loss are characteristic of the categories included. Beyond Meat, Lululemon, Oatly, SunOpta, Nestle, The Honest Company, Sprouts Farmers Market, and Peloton are representative of the group

We would love to hear from you.

David Thibodeau

david@wellvestcapital.com

Rob Rafferty

rob@wellvestcapital.com

Please visit Wellvest’s library of insights and articles at wellvestcapital.com/newsroom

Data sources: Pitchbook, Standard and Poor’s

Copyright: Wellvest Capital 2025