H&W Index April 2023 Performance Recap

May 2023

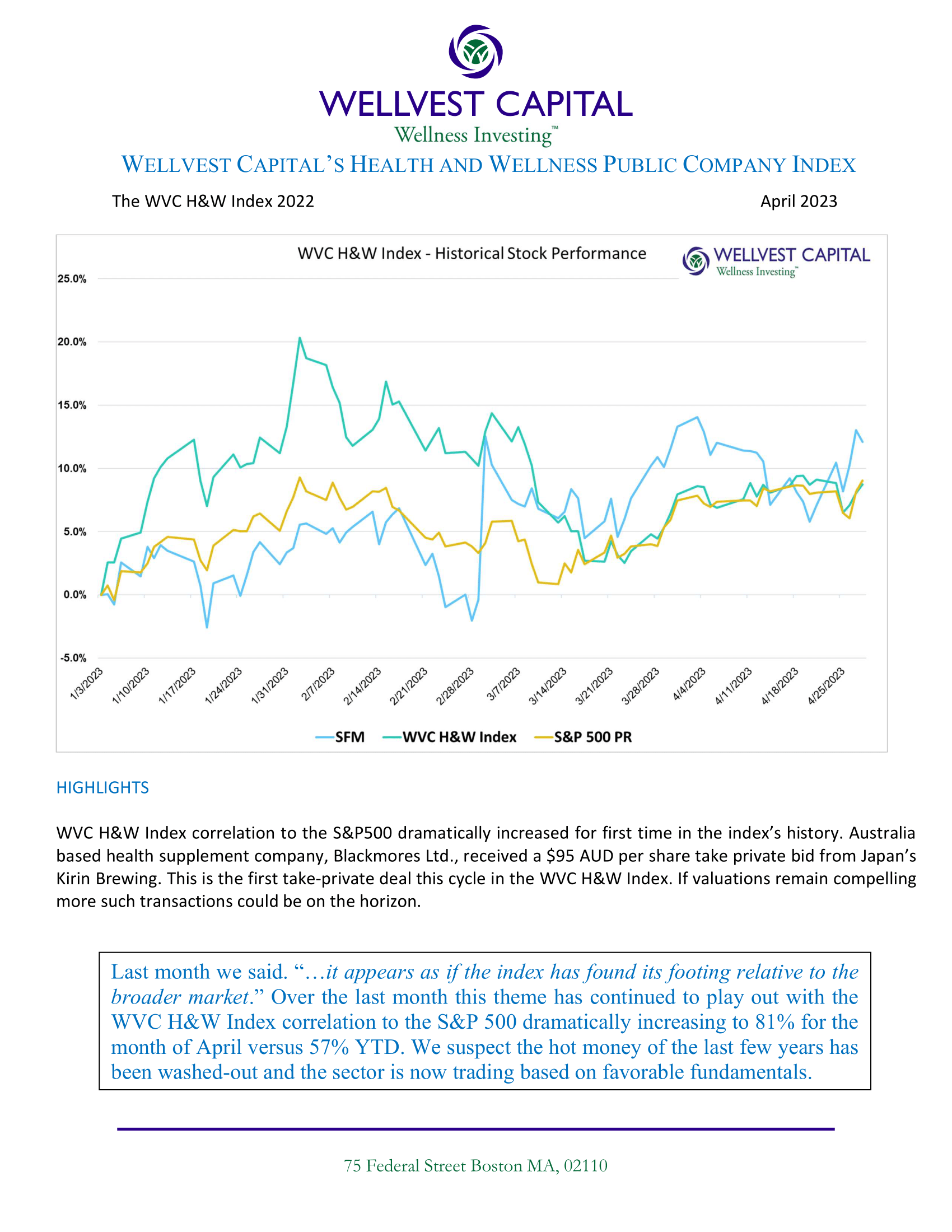

WVC H&W Index could not hold on to its impressive gains from earlier in the year, its performance is

generally in-line with the broader market. The index’s performance in May and the exuberance

around AI is very reminiscent of the beginning of the dot com run-up in the last 1990’s

APPAREL AND DURABLES IN FOCUS

The companies in the WVC H&W Index that provide fitness clothing, equipment, wearables, and other

related hard goods have experienced tremendous challenges and volatility due to pandemic driven

demand spikes, supply chain issues, and inflation. YTD the stock performance of this group has lost

5.2%, excluding dividends, as compared to S&P500 price return of 9.3%. Device maker Garmin has

delivered a 11.8% return YTD leading the group. Lululemon Athletica is still up 3.6% through May even

after May’s drawdown of -12.6%, driven by general weakness in the retail sector as consumers pull

back purchasing due to inflation and recession fears. (News Flash: LULU printed a large earnings beat

on June nd2, resulting in a large pop in the stock) Competitor Under Armour has struggled, the stock

is down 29.0% YTD driven by a forward outlook that did not meet investors’ expectations. Fitness

equipment makers Peloton and Nautilus have not done well given the post-COVID hangover, resulting

in losses of 8.3% and 17.0% for the period ending May 31, 2023. Rounded out the sub-category is

Shimano and Giant, both bike makers are about flat for the year returning negative 0.4% and positive

3.1% respectively.

H&W INDEX WINNERS and LOSERS – YTD

- Top Five Winners

- WW International (WW) 69.6%

- Natural Health Trends (NHTC) 62.4

- Basic-Fit (BFIT) 46.8

- BellRing Brands (BRBR) 42.8

- Else Nutrition Holdings (TSX:BABY) 37.7

-

Top Five Losers

- Honest Company (HNST) -51.2%

- Blue Apron (APRN) -31.8

- Medifast (MED) -31.8

- United Natural Foods (UNFI) -31.0

- Under Armour (UAA) -29.0